本文主要是介绍【源码】HFMRD:用于检测对冲基金报告中错误回报的框架,希望对大家解决编程问题提供一定的参考价值,需要的开发者们随着小编来一起学习吧!

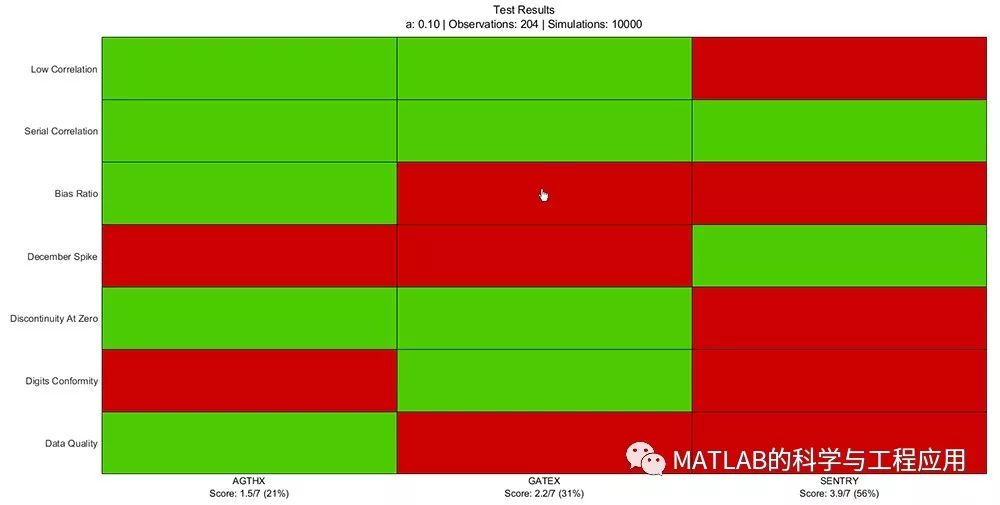

此脚本表示了一个完整的功能框架,用于通过以下测试检测对冲基金报告中的错误回报:

This script represents a full-featured framework for detecting misreported returns in hedge funds through the following tests:

> Low Correlation with Other Assets (Bollen & Pool, 2008-2010):

==> IndexRSQ

==> MaxRSQ or SwitchRSQ with change-point regression (as per Andrews et al., 1996)

> Serial Correlation (Bollen & Pool, 2008-2010):

==> Unconditional

==> Conditional

> Bias Ratio (Abdulali, 2002)

> December Spike (Agarwal et al., 2011)

> Discontinuity At Zero / Kink (Bollen & Pool, 2008-2010)

> Digits Conformity (Bollen & Pool, 2008-2010):

==> Benford's Law Conformity of First Digits

==> Uniform Distribution Conformity of Last Digits

> Data Quality (Straumann, 2008):

==> Number of Negative Returns

==> Number of Zero Returns

==> Number of Unique Returns

==> Number of Pairs of Identical Returns

==> Maximum Length of Adjacent Identical Returns

They are all based on the normality assumption of returns.

# USAGE #

1) Create a properly structured database (see the paragraph below).

2) Edit the "run.m" script following your needs.

3) Execute the "run.m" script.

The "Test Results" plot created by the "plot_results" function is interactive and based on a singleton pattern. Detailed plots concerning a specific test for a specific hedge fund can be displayed by clicking on the corresponding table cell.

# DATASET #

Datasets must be structured like the default one included in every release of the framework ("Datasets/Example.xlsx"). The latter, based on the US financial sector, defines the following entities:

> Benchmark (BM) & Risk-Free Rate (RF)

The benchmark is represented by the market proxy defined in Fama & French, 1993: the value-weighted returns of all the US CRSP firms listed on the AMEX, NASDAQ or NYSE that have a CRSP share code of 10 or 11 at the beginning of month t, good shares and price data at the beginning of t, and good return data for t. The 1M treasury bill rate is taken as the risk-free rate.

> Hedge Funds (3):

==> The Growth Fund of America - Class A (AGTHX)

==> The Gateway Fund - Class A (GATEX)

==> The Fairfield Sentry Fund of Bernard Madoff (SENTRY)

> Style Factors (18):

==> MRKEXC: the excess return on the market, calculated as benchmark minus risk-free rate.

==> Fama & French 5 Factors from the French Data Library (10)

====> CMA: conservative minus aggressive, the average return on two conservative investment portfolios minus the average return on two aggressive investment portfolios.

====> HML: high minus slow, the average return on two value portfolios minus the average return on two growth portfolios.

====> MF: the momentum factor, the average return on two high prior return portfolios minus the average return on two low prior return portfolios.

====> RMW: robust minus weak, the average return on two robust operating profitability portfolios minus the average return on two weak operating profitability portfolios.

====> SMB: small minus big, the average return on nine small stock portfolios minus the average return on nine big stock portfolios.

====> The squared values of the above factors, proposed by Bollen & Pool to capture nonlinearities in exposure generated by dynamic trading and/or derivatives.

==> Fung & Hsieh Trend-following Factors from the Hsieh Website (7)

====> PTFSBD: the returns of a portfolio of options on bonds, based on a primitive trend-following strategy.

====> PTFSFX: the returns of a portfolio of options on foreign currencies, based on a primitive trend-following strategy.

====> PTFSCO: the returns of a portfolio of options on commodities, based on a primitive trend-following strategy.

====> PTFSIR: the returns of a portfolio of options on short−term interest rates, based on a primitive trend-following strategy.

====> PTFSST: the returns of a portfolio of options on stock indices, based on a primitive trend-following strategy.

====> TBR10Y: the 10Y treasury bond rate.

====> CRESPR: the change in the credit spread (the BAA corporate bond rate minus the 10Y treasury bond rate).

For what concerns the financial time series:

> they must be based on a monthly frequency;

> they must contain enough observations to run consistent calculations (a minimum of 120 observations for at least 3 hedge funds is required);

> they must have been previously validated and preprocessed by removing rows with NaNs or filling the gaps with an interpolation approach;

> a minimum of 3 style factors is required;

> groups are optional, hence their sheet must be removed from the dataset if all the hedge funds are assumed to belong to the same style.

完整资料领取请加QQ群免费下载:

这篇关于【源码】HFMRD:用于检测对冲基金报告中错误回报的框架的文章就介绍到这儿,希望我们推荐的文章对编程师们有所帮助!