本文主要是介绍2019新旧版五险一金和年终奖对比,希望对大家解决编程问题提供一定的参考价值,需要的开发者们随着小编来一起学习吧!

代码如下:

#!/usr/bin/python

# -*- coding: utf-8 -*-"""@file: calculate.py

@author: xiaoxiao

@date: 2018-07-07 17:30:32"""class Calculate(object):def __init__(self, base_limit, tax_base, tax_3, tax_10, tax_20, tax_25, tax_30, tax_35):self.base_limit = base_limitself.tax_base = tax_baseself.tax_3 = tax_3self.tax_10 = tax_10self.tax_20 = tax_20self.tax_25 = tax_25self.tax_30 = tax_30self.tax_35 = tax_35# ********** 公积金 ********** ## 计算公积金个人缴纳:12%def calculate_personal_accumulation_fund(self, n):if n < self.base_limit:return n * 0.12else:return self.base_limit * 0.12# 计算公积金单位缴纳:12%def calculate_unit_accumulation_fund(self, n):if n < self.base_limit:return n * 0.12else:return self.base_limit * 0.12# ********** 养老保险 ********** ## 计算养老保险个人缴纳:8%def calculate_personal_endowment_insurance(self, n):if n < self.base_limit:return n * 0.08else:return self.base_limit * 0.08# 计算养老保险单位缴纳:19%def calculate_unit_endowment_insurance(self, n):if n < self.base_limit:return n * 0.19else:return self.base_limit * 0.19# ********** 失业保险 ********** ## 计算失业保险个人缴纳:0.0%def calculate_personal_unemployment_insurance(self, n):if n < self.base_limit:return n * 0.00else:return self.base_limit * 0.00# 计算失业保险单位缴纳:0.8%def calculate_unit_unemployment_insurance(self, n):if n < self.base_limit:return n * 0.008else:return self.base_limit * 0.008# ********** 工伤保险 ********** ## 计算工伤保险个人缴纳:0.0%def calculate_personal_injury_insurance(self, n):if n < self.base_limit:return n * 0.00else:return self.base_limit * 0.00# 计算工伤保险单位缴纳:0.4%def calculate_unit_injury_insurance(self, n):if n < self.base_limit:return n * 0.004else:return self.base_limit * 0.004# ********** 生育保险 ********** ## 计算生育保险个人缴纳:0.0%def calculate_personal_maternity_insurance(self, n):if n < self.base_limit:return n * 0.00else:return self.base_limit * 0.# 计算生育保险单位缴纳:0.4%def calculate_unit_maternity_insurance(self, n):if n < self.base_limit:return n * 0.004else:return self.base_limit * 0.004# ********** 医疗保险 ********** ## 计算医疗保险个人缴纳:2%+3def calculate_personal_medical_insurance(self, n):if n < self.base_limit and n >= 3:return n * 0.02 + 3elif n > self.base_limit:return self.base_limit * 0.02 + 3else:return 0.00# 计算医疗保险单位缴纳:10%def calculate_unit_medical_insurance(self, n):if n < self.base_limit:return n * 0.10else:return self.base_limit * 0.10# ********** 个人所得税 ********** #def calculate_personal_income_tax(self, m):m = m - self.tax_baseif m <= 0:return 0elif m < self.tax_3:return m * 0.03elif m < self.tax_10:return m * 0.10 - self.tax_3 * 0.07elif m < self.tax_20:return m * 0.20 - self.tax_10 * 0.1 - self.tax_3 * 0.07elif m < self.tax_25:return m * 0.25 - self.tax_20 * 0.05 - self.tax_10 * 0.1 - self.tax_3 * 0.07elif m < self.tax_30:return m * 0.30 - self.tax_25 * 0.05 - self.tax_20 * 0.05 - self.tax_10 * 0.1 - self.tax_3 * 0.07elif m < self.tax_35:return m * 0.35 - self.tax_30 * 0.05 - self.tax_25 * 0.05 - self.tax_20 * 0.05 - self.tax_10 * 0.1 - self.tax_3 * 0.07else:return m * 0.45 - self.tax_35 * 0.1 - self.tax_30 * 0.05 - self.tax_25 * 0.05 - self.tax_20 * 0.05 - self.tax_10 * 0.1 - self.tax_3 * 0.07# 计算旧版年终奖扣税def calculate_year_award_tax_old(self, salary, year_award):tax = 0.0base_salary = 3500# 如果年终奖减去最低扣税基数与基本工资的差额小于0,则不用扣税if year_award - base_salary + salary <= 0:return taxif salary > base_salary:if year_award / 12 < 1500:tax = year_award * 0.03 - 0elif year_award / 12 < 4500:tax = year_award * 0.10 - 105elif year_award /12 < 9000:tax = year_award * 0.20 - 555elif year_award / 12 < 35000:tax = year_award * 0.25 - 1005elif year_award / 12 < 55000:tax = year_award * 0.30 - 2755elif year_award / 12 < 80000:tax = year_award * 0.35 - 5505elif year_award > 80000:tax = year_award * .045 - 80000else:print ("Input year_award = %s" % year_award)else:if year_award / 12 < 1500:tax = (year_award - base_salary + salary) * 0.03 - 0elif year_award / 12 < 4500:tax = (year_award - base_salary + salary) * 0.10 - 105elif year_award /12 < 9000:tax = (year_award - base_salary + salary) * 0.20 - 555elif year_award / 12 < 35000:tax = (year_award - base_salary + salary) * 0.25 - 1005elif year_award / 12 < 55000:tax = (year_award - base_salary + salary) * 0.30 - 2755elif year_award / 12 < 80000:tax = (year_award - base_salary + salary) * 0.35 - 5505elif year_award > 80000:tax = (year_award - base_salary + salary) * .045 - 13505else:print ("Input year_award = %s" % year_award)return tax# 计算新版年终奖扣税def calculate_year_award_tax_new(self, salary, year_award):tax = 0.0base_salary = 5000# 如果年终奖减去最低扣税基数与基本工资的差额小于0,则不用扣税if year_award - base_salary + salary <= 0:return taxif salary > base_salary:if year_award / 12 < 3000:tax = year_award * 0.03 - 0elif year_award / 12 < 12000:tax = year_award * 0.10 - 210elif year_award /12 < 25000:tax = year_award * 0.20 - 1410elif year_award / 12 < 35000:tax = year_award * 0.25 - 2660elif year_award / 12 < 55000:tax = year_award * 0.30 - 4410elif year_award / 12 < 80000:tax = year_award * 0.35 - 7160elif year_award > 80000:tax = year_award * .045 - 15160else:print ("Input year_award = %s" % year_award)else:if year_award / 12 < 1500:tax = (year_award - base_salary + salary) * 0.03 - 0elif year_award / 12 < 4500:tax = (year_award - base_salary + salary) * 0.10 - 105elif year_award /12 < 9000:tax = (year_award - base_salary + salary) * 0.20 - 555elif year_award / 12 < 35000:tax = (year_award - base_salary + salary) * 0.25 - 1005elif year_award / 12 < 55000:tax = (year_award - base_salary + salary) * 0.30 - 2755elif year_award / 12 < 80000:tax = (year_award - base_salary + salary) * 0.35 - 5505elif year_award > 80000:tax = (year_award - base_salary + salary) * .045 - 80000else:print ("Input year_award = %s" % year_award)return taxsalary = input('请输入工资数:')

if salary:salary = int(salary)

else:salary = 0# 其它补贴

allowance = input('其它补贴:')

if allowance:allowance = int(allowance)

else:allowance = 0year_award = input('请输入年终奖:')

if year_award:year_award = int(year_award)

else:year_award = 0calculation = Calculate(25401, 3500, 1500, 4500, 9000, 35000, 55000, 80000)

calculation_new = Calculate(25401, 5000, 3000, 12000, 25000, 35000, 55000, 80000)# ***** 公积金 ****** #

calculate_personal_accumulation_fund = calculation.calculate_personal_accumulation_fund(salary)

calculate_unit_accumulation_fund = calculation.calculate_unit_accumulation_fund(salary)

# print '缴纳的公积金为:' + str(calculate_personal_accumulation_fund + calculate_unit_accumulation_fund)# ***** 养老保险 ***** #

calculate_personal_endowment_insurance = calculation.calculate_personal_endowment_insurance(salary)

calculate_unit_endowment_insurance = calculation.calculate_unit_endowment_insurance(salary)# ***** 失业保险 ***** #

calculate_personal_unemployment_insurance = calculation.calculate_personal_unemployment_insurance(salary)

calculate_unit_unemployment_insurance = calculation.calculate_unit_unemployment_insurance(salary)# ***** 工伤保险 ***** #

calculate_personal_injury_insurance = calculation.calculate_personal_injury_insurance(salary)

calculate_unit_injury_insurance = calculation.calculate_unit_injury_insurance(salary)# ***** 生育保险 ***** #

calculate_personal_maternity_insurance = calculation.calculate_personal_maternity_insurance(salary)

calculate_unit_maternity_insurance = calculation.calculate_unit_maternity_insurance(salary)# ***** 医疗保险 ***** #

calculate_personal_medical_insurance = calculation.calculate_personal_medical_insurance(salary)

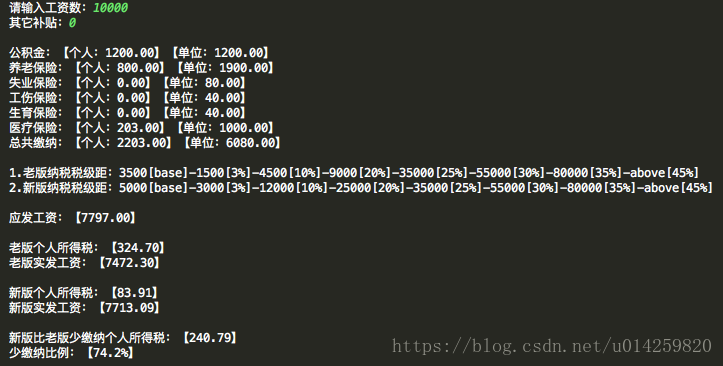

calculate_unit_medical_insurance = calculation.calculate_unit_medical_insurance(salary)print('\n公积金:【个人:%.2f】【单位:%.2f】' % (calculate_personal_accumulation_fund, calculate_unit_accumulation_fund))

print('养老保险:【个人:%.2f】【单位:%.2f】' % (calculate_personal_endowment_insurance, calculate_unit_endowment_insurance))

print('失业保险:【个人:%.2f】【单位:%.2f】' % (calculate_personal_unemployment_insurance, calculate_unit_unemployment_insurance))

print('工伤保险:【个人:%.2f】【单位:%.2f】' % (calculate_personal_injury_insurance, calculate_unit_injury_insurance))

print('生育保险:【个人:%.2f】【单位:%.2f】' % (calculate_personal_maternity_insurance, calculate_unit_maternity_insurance))

print('医疗保险:【个人:%.2f】【单位:%.2f】' % (calculate_personal_medical_insurance, calculate_unit_medical_insurance))

personal_all = calculate_personal_accumulation_fund + calculate_personal_endowment_insurance + calculate_personal_unemployment_insurance + calculate_personal_injury_insurance + calculate_personal_maternity_insurance + calculate_personal_medical_insurance

unit_all = calculate_unit_accumulation_fund + calculate_unit_endowment_insurance + calculate_unit_endowment_insurance + calculate_unit_injury_insurance + calculate_unit_maternity_insurance + calculate_unit_medical_insurance

print('总共缴纳:【个人:%.2f】【单位:%.2f】\n' % (personal_all, unit_all))# ***** 税前应发工资 ***** #

total_pay_amount = salary - personal_all + allowanceprint("1.老版纳税税级距:3500[base]-1500[3%]-4500[10%]-9000[20%]-35000[25%]-55000[30%]-80000[35%]-above[45%]")

print("2.新版纳税税级距:5000[base]-3000[3%]-12000[10%]-25000[20%]-35000[25%]-55000[30%]-80000[35%]-above[45%]")# ***** 缴纳的个人所得税 ***** #

personal_tax_old = calculation.calculate_personal_income_tax(total_pay_amount)

personal_tax_new = calculation_new.calculate_personal_income_tax(total_pay_amount)print('\n应发工资:【%.2f】\n' % total_pay_amount)print('老版个人所得税:【%.2f】' % personal_tax_old)

final_paying_amount_old = total_pay_amount - personal_tax_old

print('老版实发工资:【%.2f】\n' % final_paying_amount_old)print('新版个人所得税:【%.2f】' % personal_tax_new)

final_paying_amount_new = total_pay_amount - personal_tax_new

print('新版实发工资:【%.2f】' % final_paying_amount_new)print('\n新版比老版少缴纳个人所得税:【%.2f】' % (personal_tax_old - personal_tax_new))

if personal_tax_old > 0:print('少缴纳比例:【%.1f%%】' % ((personal_tax_old - personal_tax_new) / personal_tax_old * 100))print ('\n')

year_award_tax_old = calculation.calculate_year_award_tax_old(salary, year_award)

year_award_tax_new = calculation.calculate_year_award_tax_new(salary, year_award)

print('老版年终奖所得扣税如下:')

print('年终奖金额 旧版扣税 新版扣税 旧版年终奖最终所得 新版年终奖最终所得')

print(' ' + str(year_award) + ' ' + str(year_award_tax_old) + ' ' + str(year_award_tax_new) + ' ' +str(year_award - year_award_tax_old) + ' ' + str(year_award - year_award_tax_new))

year_salary_old = final_paying_amount_old + year_award - year_award_tax_old

year_salary_new = final_paying_amount_new + year_award - year_award_tax_new

print('\n年终奖新版比老版少缴纳所得税:【%.2f】' % (year_award_tax_old - year_award_tax_new))

if year_award_tax_old > 0:print('少缴纳比例:【%.1f%%】' % ((year_award_tax_old - year_award_tax_new) / year_award_tax_old * 100))print('旧版年终那个月最终工资所得:' + str(year_salary_old))

print('新版年终那个月最终工资所得:' + str(year_salary_new))

print('\n年终奖那个月新版比老版总共少缴纳所得税:【%.2f】' % (personal_tax_old - personal_tax_new + year_award_tax_old - year_award_tax_new))

if year_award_tax_old > 0:print('少缴纳比例:【%.1f%%】' % ((personal_tax_old - personal_tax_new + year_award_tax_old - year_award_tax_new) / (personal_tax_old + year_award_tax_old) * 100))计算结果:

由此可见,在不计算其它补贴的情况下,纯月薪10000,以前到手7472.30元,现在到手7713.09元。缴纳的个税,相比之前的324.70元,现在只需缴纳83.91元,可以少交税240.79元,少缴纳了74.2%。

这篇关于2019新旧版五险一金和年终奖对比的文章就介绍到这儿,希望我们推荐的文章对编程师们有所帮助!