本文主要是介绍Quant of the Year (2000 - 2021),希望对大家解决编程问题提供一定的参考价值,需要的开发者们随着小编来一起学习吧!

前几天看到了 Quant of the Year 2021 颁布的新闻,颁给了 Jim Gatheral (写 The Volatility Surface - a practioner's guide 一书的作者)和 Mathieu Rosenbaum,他们研究的课题是 The Rough Volatility。

Jim Gatheral 很早就意识到随机波动率的局限性,当他接收到分数布朗运动(fractional Brownian motion)时,他惊呼这就是上帝模型(God's model)。以此为基础的 rough volatility 模型可以异常准确的捕捉到波动率市场的各种模型,而这是传统布朗运动做不到的。

下面就简要回顾下这 20 年年度最佳宽客做了什么吧。

2021 年

Jim Gatheral

Mathieu Rosenbaum

论文:The quadratic rough Heston model and the joint S&P 500/Vix smile calibration problem

The application of the rough vol model will make the Vix option market become more efficient. -- Huaming Jin, Luoshu Investments

新闻链接:

https://www.risk.net/awards/7736196/quants-of-the-year-jim-gatheral-and-mathieu-rosenbaum

亮点:以分数布朗运动为基础建立 rough volatility 模型,准确的捕捉到波动率市场上各种典型特质。

Quant 和 Trader 长期被困扰的一个问题就是 S&P 和 VIX 期权的标的都是 S&P500 指数,但是从两个期权市场得到的隐含波动率却不同。如果有个模型能够同时校正 S&P 和 VIX 期权的波动率平面,那么该模型能够识别好的交易机会。

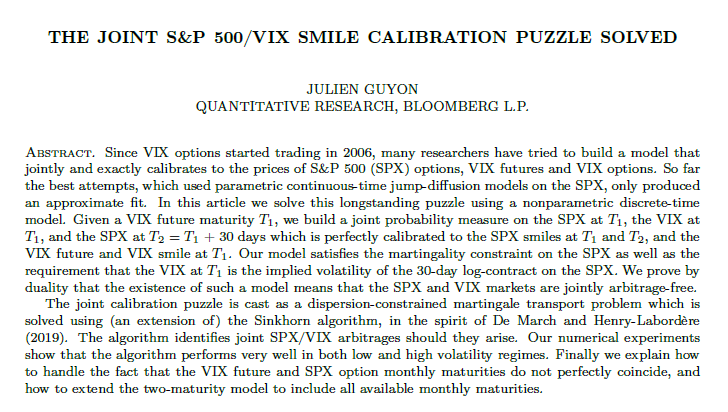

之前 Julien Guyon 其实已经解决了此问题,不过用的是一个 non-parametric 模型。

Rosenbaum 参加了 Guyon 的讲演,立即实现了这项工作的重要性,之后和 Gatheral 发现用 quadratic rough Heston 模也型可以完美校正 SPX-VIX 联合校正。

2020 年

Andrei Lyashenko

Fabio Mercurio

论文:Libor replacement: a modelling framework for in-arrears rates

In terms of topicality, applicability and broadness, it doesn’t get much bigger than this. -- Leif Andersen, Bank of America Merrill Lynch

新闻链接:

https://www.risk.net/awards/7204391/quants-of-the-year-andrei-lyashenko-and-fabio-mercurio

亮点:提出了更为通用的 Forward Market Model (FMM),它可以同时处理后顾型的 RFR 复合利率和前瞻型的 IBOR。

该论文主要解决了用 RFR 复合利率来替代 IBOR 的痛点,即两者的利率范式都不同

前者是后顾型(backward-looking)利率,在终止日才能知道其值

后者是前瞻型(forward-looking)利率,在起始日就已经知道其值

解决方案就是设计出一个「前瞻型」的 RFR 复合利率。具体来讲在区间 [Tn-1, Tn] 上用 Fn(t) 来代表这样的前瞻型利率,它和 LIBOR Market Model (LMM) 里的 IBOR Ln(t) 的范式相同,都是在 Tn-1 上定盘,而且利率有效的期限都是 [Tn-1, Tn]。

但在定价利率复杂产品时需要对一连串的 Fn(t) 进行建模,这时我们需要在某个特定测度下推出每个Fn(t) (n = 1, 2, ..., N) 的随机微分方程(Stochastic Differential Equation, SDE)。类比 LMM 的叫法,对 Fn(t) 建的模型就叫做 FMM,全称是 Forward Market Model。

关于 FMM,我也写了三篇文章,供大家参考。

FMM 大战 LMM - SOFR 企稳 Part I

FMM 大战 LMM - SOFR 企稳 Part II

FMM 大战 LMM - SOFR 企稳 Part III

2019 年

Alexei Kondratyev

论文 1:Curve Dynamics with Artificial Neural Networks

论文 2:Evolutionary Algos for Optimising MVA

Quants these days tend to maintain expertise in specific fields. With Alexei, his expertise in multiple, unrelated fields gives him a broader perspective and makes him a great researcher. -- Alexander Sokol

新闻链接:

https://www.risk.net/awards/6159246/quant-of-the-year-alexei-kondratyev

亮点:用机器学习的法来解决卖方 (sell side) 的问题。

机器学习其实在金融上的应用主要都在买方 (buy side), 比如私募或者基金,而 Alexei 的主要贡献是在卖方如银行中找到了两个应用:

用人工神经网络 + 正则化,和自动编码器来捕捉利率曲线和商品远期曲线里的动态关系。【论文 1】

用遗传算法 (Genetic Algorithm, GA) 和粒子群优化 (Particle Swarm Optimization, PSO) 来为银行压缩交易而减少保证金 (margin)。两个都是进化算法,GA 主要在离散型变量空间 (比如货币 currency, 交易对手 counterparty) 找最优解,而 PSO 主要在连续性变量空间 (比如年限 tenor, 本金 notional) 找最优解。【论文 2】

论文还要好好读,至少现在我觉得第一篇的 input 的选择就有些不合理,可能犯了数据窥探 (data snooping) 的错误。Alexei 目前还在研究量子计算 (Quantum Computing),和 NASA 合作把量子计算应用在一个含 60 个资产的组合优化上,节省了一半的计算时间。(是不是有点小题大做了?)

2018 年

Leif Andersen

Michael Pykhtin

Alexander Sokol

论文:Does Initial Margin Eliminate Counterparty Risk

They looked at the entire complexities of the margining process and modelled it mathematically. They looked at things from first principles and the result was amazing. -- Alexei Kondratyev

新闻链接:

https://www.risk.net/awards/5371021/quants-of-the-year-leif-andersen-michael-pykhtin-and-alexander-sokol

亮点:深挖交易对手违约后的细节,将保证金风险期 (Margin Period of Risk, MPOR) 分解成四个时段来分析并量化了之前从来没有人去想要量化的结算风险 (settlement risk)。

2017 年

Jean-Philippe Bouchaud

论文:Cleaning Correlation Matrices

It is really more of a physics approach, to let the data speak. A lot of models used in mathematical finance seem to be more driven by their convenience and the possibility to answer a question with a number, rather than taking the time and thinking about the problem. -- Bouchaud

新闻链接:

https://www.risk.net/risk-magazine/analysis/2479713/quant-of-the-year-jean-philippe-bouchaud

亮点:用实证研究 (emprical reseach) 和数据,而不是用理论的公式来处理相关系数矩阵。

2016 年

Alexander Antonov

论文 1:The Free Boundary SABR Natural Extension to Negative Rates

论文 2:FVA for General Instruments

论文 3:Backward Induction for Future Values

In all his papers there is a clear practical problem, amazing mathematics and practical implementation. I think the combination of those three elements is really quant work at its best. -- Paul Glasserman

新闻链接:

https://www.risk.net/awards/2442477/quant-of-the-year-alexandre-antonov

亮点:在负利率环境下的提出自由边界 (free boundary) SABR 模型,欧式期权仍有解析解或者近似解析解,校正快,计算敏感度也没有之前 shifted SABR 模型产生的跳跃的现象。

2015 年

Christoph Burgard

Mats Kjaer

论文:Funding Strategies, Funding Costs

The way they have approached the problem is revolutionary. They have gone back to basics and modified the Black-Scholes PDE. And because it is intuitive, it is very revealing in that you can see the cashflows in a very transparent way. -- Andrew Green

新闻链接:

https://www.risk.net/derivatives/2387793/quants-year-christoph-burgard-and-mats-kjaer

亮点:为业界各说各话的融资估值调整 (Funding Valuation Adjustment, FVA) 提出一个健全的理论框架。

2014 年

Michael Pykhtin

论文:Exposure under Systemic Impact

Systemic risk is at the forefront of everyone’s mind but is notoriously difficult to quantify. Pykhtin’s clear and pragmatic approach goes a long way towards setting a rigorous framework to measure and control it. -- Vladimir Piterbarg

新闻链接:

https://www.risk.net/awards/2320285/quant-year-michael-pykhtin

亮点:专门针对于系统重要性交易对手 (Systemically Important Counterparty, SIC) 提出系统内错向风险 (Systemic Wrong-Way Risk, SWWR) 来量化它们违约造成的后果。

I see this as an important part of my role – communicating these technical details, This dialogue between industry and regulator is an increasingly valuable function as rules and guidelines get more technical. It’s familiar to Pykhtin – from both sides.

2013 年

Pierre Henry-Labordère

论文 1:Being Particular about Calibration

论文 2:Cutting CVA's Complexity

It’s not complicated, actually. Using Malliavin is no harder than using the Itô lemma or the Girsanov theorem. -- Pierre Henry-Labordère

新闻链接:

https://www.risk.net/awards/2232028/quant-of-the-year-pierre-henry-labordere-societe-generale

亮点:用法国人逆天的数学来在金融界炫耀,当然大量的减少了两大难题的计算量,分别是“局部随机波动率 (Local Stochastic Volatility, LSV) 模型校正”和“组合层面的信用估值调整 (Credit Valuation Adjustment, CVA) 计算”。

2012 年

Jesper Andreasen

Brian Huge

论文 1:Volatility Interpolation

论文 2

:Random Grids

There are no fundamental laws handed down from God on clay tablets. I think there is still a tendency to see the world through models, forgetting they are only as good as their implementation. -- Jesper andreasen

新闻链接:

https://www.risk.net/awards/2133160/quants-year-jesper-andreasen-and-brian-huge-danske-bank

亮点:1. 找到一种无套利的波动率插值方法;2. 提出一个模型校正、偏微分方程有限差分和蒙特卡洛模拟的一致离散化的想法。

2011 年

Vladimir Piterbarg

论文:Funding Beyond Discounting Collateral Agreements and Derivatives Pricing

What Piterbarg is doing is rewriting Black-Scholes post-financial crisis. After the crisis, you can’t ignore the cost of funding in any asset class or you lose money. -- Alex Langnau

新闻链接:

https://www.risk.net/awards/1934297/quant-year-vladimir-piterbarg-barclays-capital

亮点:对衍生品定价时引入融资成本 (cost of funding),而且这些调整可以完美的添加到整套 Black-Scholes 框架中。

2010 年

Marco Avellaneda

论文:A dynamic Model for Hard-to-Borrow Stocks

Short selling is a common scapegoat during financial crises. In 2008, the ban on short selling was also used as a form of protectionism for propping up the stock of financial firms. -- Marco Avellaneda

新闻链接:

https://www.risk.net/awards/1567801/quant-of-the-year-marco-avellaneda

亮点:对于难以去借 (hard-to-borrow) 来做空的股票,买卖权平价关系 (put-call parity) 不在适用。

2009 年

Lozenro Bergomi

论文:Smile Dynamics III

His idea of directly modelling the joint dynamics of the spot and variance swap volatility is theoretically sound and practically easy to implement. His quant of the year award is well deserved. -- Alexander Lipton

新闻链接:

https://www.risk.net/awards/1496978/quant-year-lorenzo-bergomi

亮点:提出可以控制远期方差微笑 (smile of forward variance) 而且可以校正于波动率指数 (volatility index, VIX) 期货和期权的模型。

2008 年

Dilip Madan

论文:Calibrating and Pricing with Embedded Local Volatility Models

The most important moment of my career was my meeting with professor Dilip Madan. He is one of the few academics that are aware that the future does not behave like the past. -- Peter Carr

新闻链接:

https://www.risk.net/awards/1498261/quant-year-dilip-madan

亮点:提出一个内嵌型的局部波动率模型 (embedded local volatility model) 来对波动率指数期权、股票和利率混合产品进行定价。

2007 年

Paul Glasserman

Michael Giles

论文:Smoking Adjoints Fast Monte Carlo Greeks

The adjoint method accelerates the calculation of Greeks via Monte Carlo simulation by, in essence, rearranging the order of calculations, as compared to the standard method. -- Paul Glasserman

新闻链接:

https://www.risk.net/awards/1498251/quants-year-paul-glasserman-and-michael-giles

亮点:用反向方法 (adjoint method) 来计算复杂衍生物的敏感度,比传统的有限差分 (finite)、路径微分和似然比在计算敏感度的精度不减速度却爆升。

2006 年

Vladimir Piterbarg

论文:Time to Smile

The global skew is some sort of average of local skew. -- Vladimir Piterbarg

新闻链接:

https://www.risk.net/awards/1497820/quant-year-vladimir-piterbarg

亮点:提出参数平均 (parameter averaging) 的想法,将和时间有关的参数比如偏斜 (skew)、波动率转换成和时间无关的有效 (effective) 参数,加快了复杂模型的校正速度确没有降低校正质量。

2005 年

Philipp Schönbucher

论文:A Measure of Survival

Schönbucher is one of the most innovative researchers in credit and many of today’s practitioners have benefited from his insights. His work on CDS option pricing is typically focused and thorough, and will form the backbone of future work on the subject. -- Richard Martin

新闻链接:

https://www.risk.net/awards/1497632/quant-year-philipp-schonbucher

亮点:用可违约资产 (defaultable asset) 当计价物 (numeraire),在各种波动率设定下推导出类似 Black-Scholes 公式来对信用违约互换期权 (CDS option) 进行定价。

2004 年

Michael Gordy

论文:Random Tranches

Gordy’s work in portfolio credit risk is both distinguished and topical, with many of his papers being among the cornerstones of modern credit risk management practices. His work at the Federal Reserve has been highly influential with academics and practitioners alike. -- Leif Andersen

新闻链接:

https://www.risk.net/awards/1498479/quant-year-michael-gordy-us-fed

亮点:在符合巴塞尔大框架下,提出了一个简单公式,能计算证券化分层所需的监管资本,解决了巴塞尔对此类产品提出过于复杂要求的监管痛点。

2003 年

Peter Carr

论文:Black-Scholes Goes Hypergeometric

Peter has contributed more fundamental ideas to the area of mathematical finance in the past couple of years than anyone I am aware of. Peter lives, eats and breathes mathematical finance. -- Keith Lewis

新闻链接:

https://www.risk.net/derivatives/1506232/quant-of-the-year-peter-carr

亮点:用不同的波动率设定来推广 Black-Scholes 公式,并推导欧式期权和障碍期权的解析解。

2002 年

Richard Martin

论文:Taking to the Saddle

In credit risk modelling, he’s the most switched on person I know. -- Tom Wilde

新闻链接:

https://www.risk.net/awards/1506446/2002-winner-quant-year-richard-martin

亮点:用鞍点法 (saddle-point method) 代替了蒙特卡洛模拟来对损失事件建模和计算组合损失分布。

2001 年

Leif Andersen

Jesper Andreasen

论文 1:Jumping Smiles

论文 2:Static Barriers

无新闻链接

亮点:1. 提出跳跃扩散 (Jump-Diffusion) 模型改进局部波动率模型,因为后者生成的微笑曲线随着时间越来越平,不符合实证观察。2. 引进跳跃扩散模型来静态对冲障碍期权。

2000 年

Alexander Lipton

论文:Similarities Via Self-Similarities

无新闻链接

到处都下载不到他的论文,甚至都很难搜索出来。听说是关于介绍复杂衍生物的定价方法论,但是细节不清楚因此不评价。

◯

总结

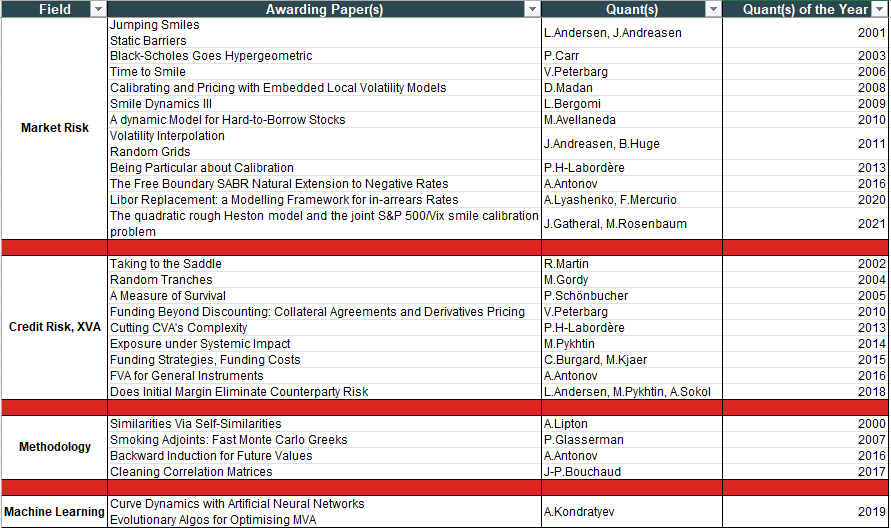

这 20 年的年度宽客和他们得奖论文主要分成市场风险 (Market Risk),信用风险及估值调整 (Credit Risk, XVA),方法论和机器学习这四大类,如下图所示:

从上表来看,研究市场风险的趋势在下降;研究估值调整,融资成本 (funding cost) 和保证金 (initial margin) 越来越多;研究机器学习的从今年刚开始有第一篇,按着大趋势以后会越来越多。

亮点一评:2007 年的最佳论文 Smoking Adjoints: Fast Monte Carlo Greeks 真实好东西,这个 Adjoint 方法其实和机器学习里面的反向传播非常类似,这种反向求导数的方法统称 Adjoint Automatic Differentation, AAD,在金融和机器学习中有太多应用,比如百慕大期权蒙特卡洛求敏感度,比如组合层面的 XVA,比如深度神经网络的反向传播,只要求少量输出对大量输入的导数,AAD 在效率和速度上会让你重新认识这个世界。最后我大胆预测 Quant of the Year 2022 会属于 Antoine Savine 和 Brian Huge,他们研究如何用 ADD 来实现 differential machine learning。

世界越来越复杂,但能用简单优雅的模型来描述他的宽客才配的起 Quant of the Year 这个称号!

想学习 Python 内容,可参考我的《三套 Python 精品课》。

这篇关于Quant of the Year (2000 - 2021)的文章就介绍到这儿,希望我们推荐的文章对编程师们有所帮助!

![[SWPUCTF 2021 新生赛]web方向(一到六题) 解题思路,实操解析,解题软件使用,解题方法教程](https://i-blog.csdnimg.cn/direct/bcfaab8e5a68426b8abfa71b5124a20d.png)