本文主要是介绍#7.21研究目标:预测510050股指期货未来收益率,希望对大家解决编程问题提供一定的参考价值,需要的开发者们随着小编来一起学习吧!

import 需要用到的库

import pandas as pd

import numpy as np

product = 'IH'

stime = '093500'

etime = '145500'## load数据以及对数据做基本处理

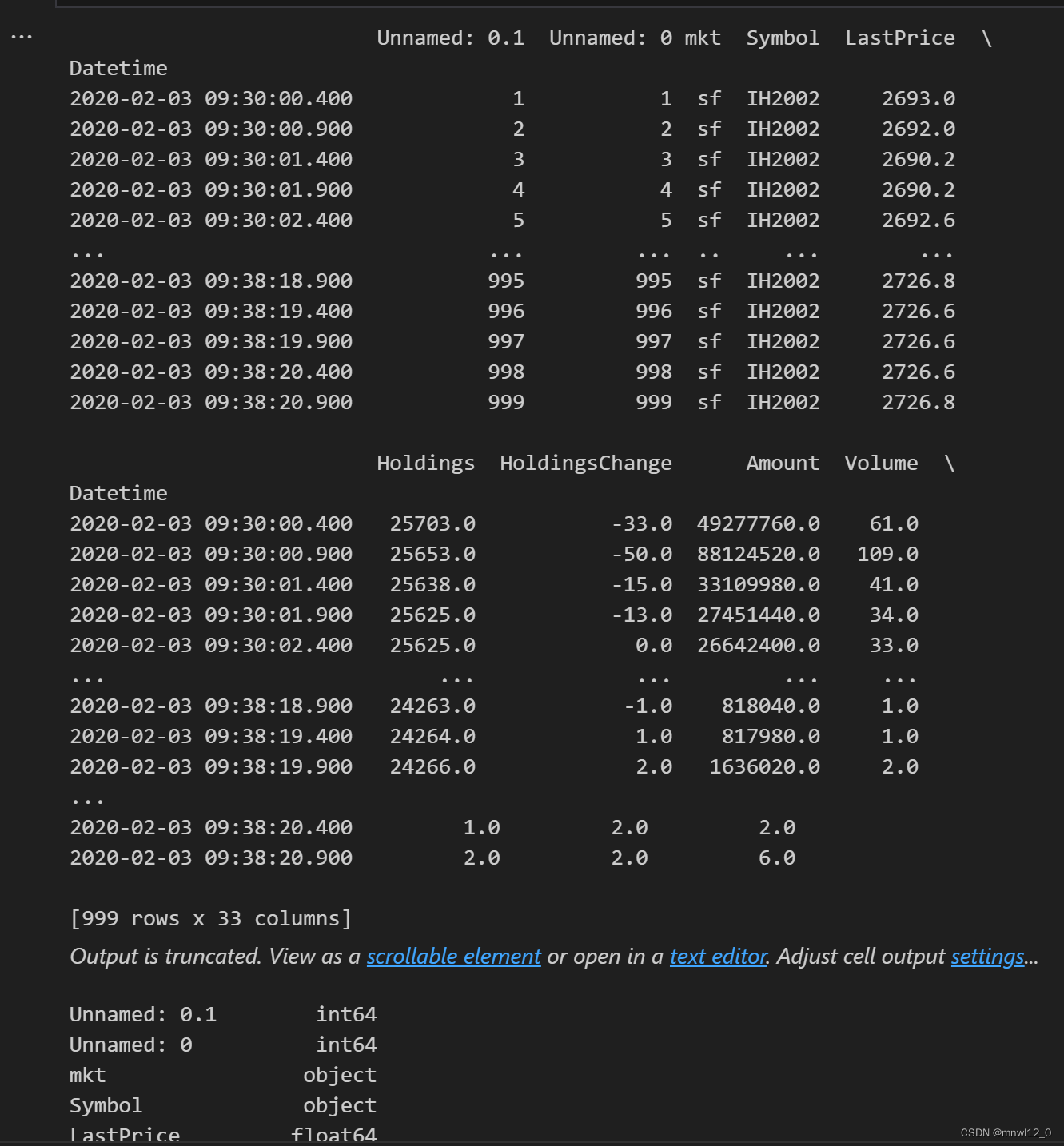

data= pd.read_csv('IH_20230720.csv'.format(product), parse_dates=['Datetime'], index_col='Datetime',encoding='utf-8')#

print(data)

data.dtypes#注意这里的日期格式要求

## 计算预测目标: 收益率

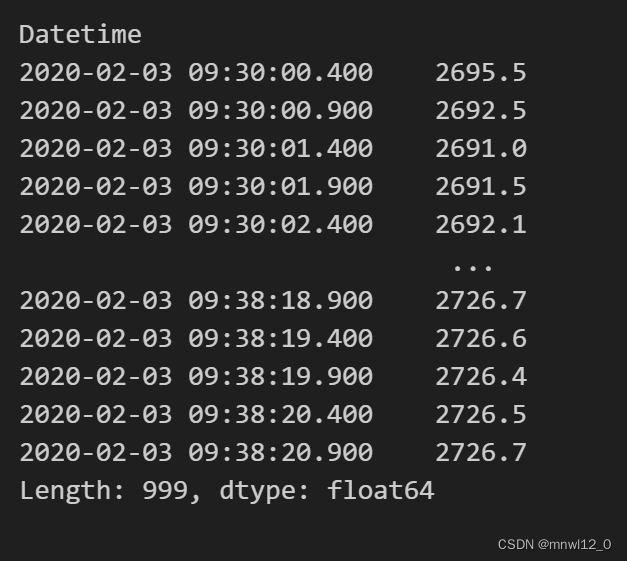

"""计算价格"""

IH_Price = (data['Bid1Price'] + data['Ask1Price'])/2

IH_Price"""计算rate of return"""

import math

RET=pd.DataFrame()

RET['return']=[math.log(IH_Price[i]/IH_Price[i-1]) for i in range(1,len(data['LastPrice']))]

RET_Index = pd.concat([RET, pd.Series(data.index[:-1])], axis=1)

RET_Index.set_index('Datetime', inplace=True)

RET_Index.dropna()"""

为什么用log return?

1. 对数收益率具有线性性质,这意味着对数收益率的加法等于对应收益率的乘法。这种线性性质使得对数收益率更易于处理和分析。

2. 对数收益率可以减小极端值的影响。金融市场中,收益率可能存在极端波动,使用对数收益率可以平滑这些波动,使得数据更加稳定,有助于建立更可靠的预测模型。

"""

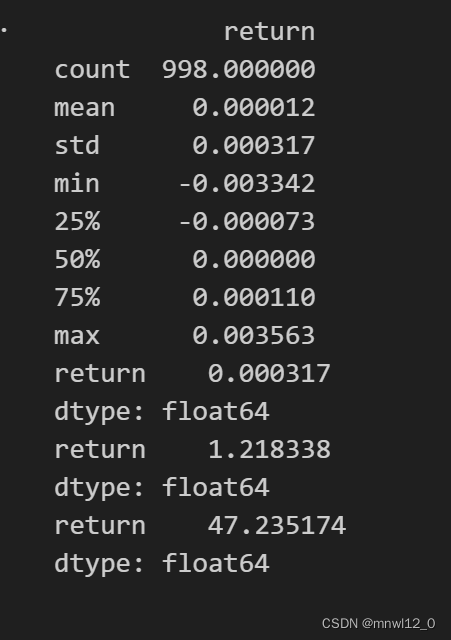

"""对收益率数据做初步处理"""

"""

我们需要对预测目标做初步的分析,包括:

1. 分布特点(矩)

2. 数值范围,包括最大最小,各分位数数值

3. 平稳性检验

4. 还有什么你们认为需要的

"""

print(RET.describe())

print(RET.std())

print(RET.skew())

print(RET.kurtosis())

# 平稳性检验

import statsmodels.api as sm

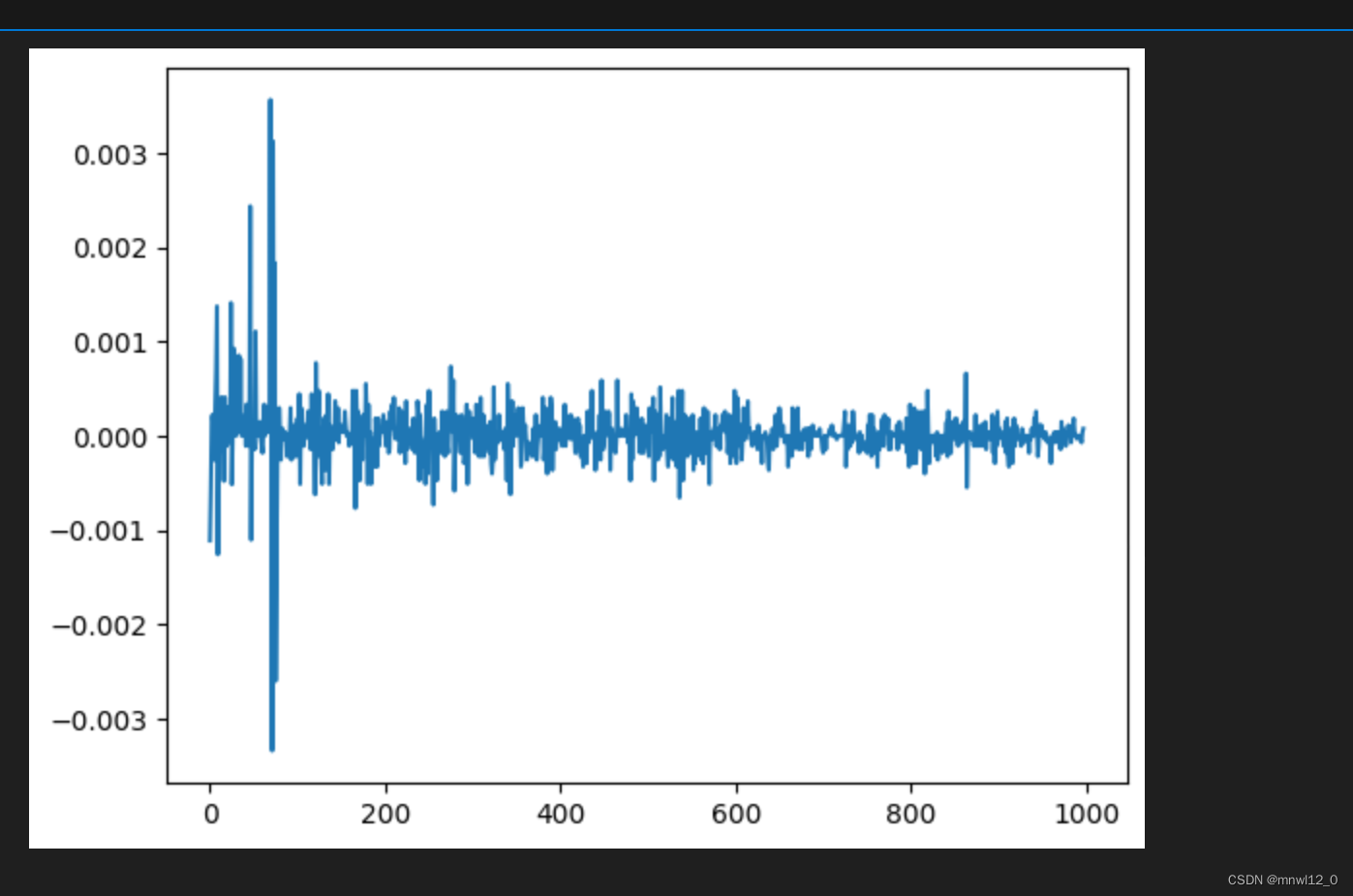

import matplotlib.pyplot as pltplt.plot(RET['return'])

plt.show()

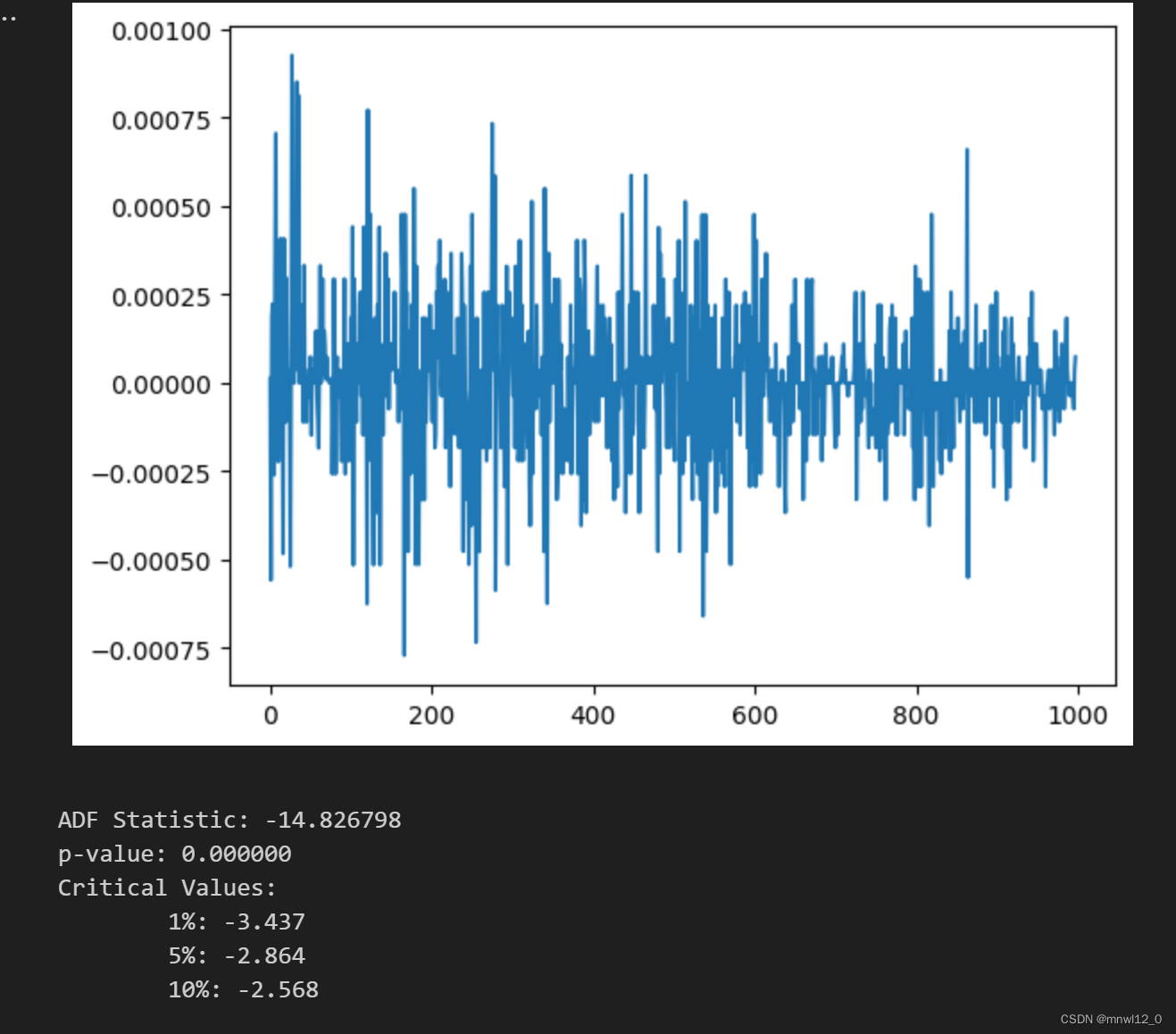

# 进行平稳性检验

mean = np.mean(RET['return'])

std = np.std(RET['return'])# 找出序列的极端值并替换为均值

for i in range(len(RET['return'])):if RET['return'][i] < mean - 3 * std or RET['return'][i] > mean + 3* std:RET['return'][i] = mean

plt.plot(RET['return'])

plt.show()adf_test = sm.tsa.adfuller(RET)

print('ADF Statistic: %f' % adf_test[0])

print('p-value: %f' % adf_test[1])

print('Critical Values:')

for key, value in adf_test[4].items():print('\t%s: %.3f' % (key, value))

# 基于上述数据分析结论,可以看出收益率是非正态分布的,非平稳的。我们可以对收益率数据RET做差分

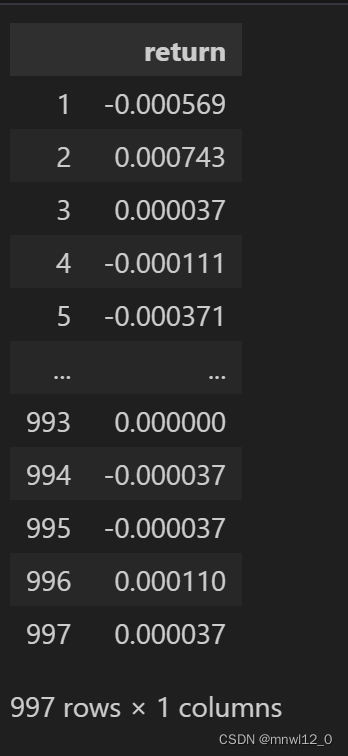

RET_diff = RET.diff(1).dropna()

RET_diff

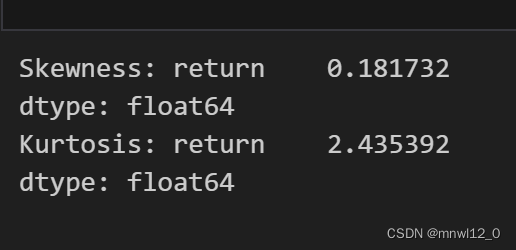

# 用numpy来计算skew和kurt

# 计算偏度

skewness = np.mean((RET - np.mean(RET))**3) / np.power(np.var(RET), 1.5)

print('Skewness:', skewness)# 计算峰度

kurtosis = np.mean((RET - np.mean(RET))**4) / np.power(np.var(RET), 2) - 3

print('Kurtosis:', kurtosis)

# 因子1: 加权平均价与成交价之差

def sig_theo2_price(data: pd.DataFrame, decay: float, stime: str, etime: str) ->pd.DataFrame:tmp_df = copy.deepcopy(data)tmp_df['bid_sz_total'] = tmp_df['Bid1Volume']+decay*tmp_df['Bid2Volume']+decay**2*tmp_df['Bid3Volume']tmp_df['ask_sz_total'] = tmp_df['Ask1Volume']+decay*tmp_df['Ask2Volume']+decay**2*tmp_df['Ask3Volume']tmp_df['bid_sz_total'][tmp_df['bid_sz_total']< 1] = 1tmp_df['ask_sz_total'][tmp_df['ask_sz_total']< 1] = 1tmp_df['bid_px_total'] = (tmp_df['Bid1Price']*tmp_df['Bid1Volume']+decay*tmp_df['Bid2Price']*tmp_df['Bid2Volume']+decay**2*tmp_df['Bid3Price']*tmp_df['Bid3Volume'])/tmp_df['bid_sz_total']tmp_df['ask_px_total'] = (tmp_df['Ask1Price']*tmp_df['Ask1Volume']+decay*tmp_df['Ask2Price']*tmp_df['Ask2Volume']+decay**2*tmp_df['Ask3Price']*tmp_df['Ask3Volume'])/tmp_df['ask_sz_total']tmp_df['theo_px'] = (tmp_df['bid_px_total']*tmp_df['ask_sz_total']+tmp_df['ask_px_total']*tmp_df['bid_sz_total'])/(tmp_df['bid_sz_total']+tmp_df['ask_sz_total'])tmp_df['sig_theo2_mid'] = tmp_df['theo_px'] - tmp_df['LastPrice']tmp_df = tmp_df[["sig_theo2_mid"]]tmp_df = pd.concat([tmp_df.between_time(stime,etime)])tmp_df = tmp_df.replace([np.inf, -np.inf], np.nan)tmp_df = tmp_df.dropna()return tmp_df['sig_theo2_mid']# 因子2: 挂单深度

def sig_depth(data: pd.DataFrame, weight: float, normalize_window: int, stime: str, etime: str) ->pd.DataFrame:df = copy.deepcopy(data)df['sig_depth'] = 0.for i in range(1, 6):df['sig_depth_{}'.format(i)] = (df['Ask{}Volume'.format(i)]-df['Bid{}Volume'.format(i)])/(df['Ask{}Volume'.format(i)]+df['Bid{}Volume'.format(i)])df['sig_depth'] += weight**i * df['sig_depth_{}'.format(i)] df['depth_mean'] = df['sig_depth'].rolling(normalize_window, min_periods=1).mean()df['depth_std'] = df['sig_depth'].rolling(normalize_window, min_periods=1).std()df['sig_depth'] = (df['sig_depth']-df['depth_mean'])/df['depth_std']df = df.replace([np.inf, -np.inf], np.nan)df = df.dropna()df = pd.concat([df.between_time(stime, etime)])df = df['sig_depth']return df"""计算因子值"""

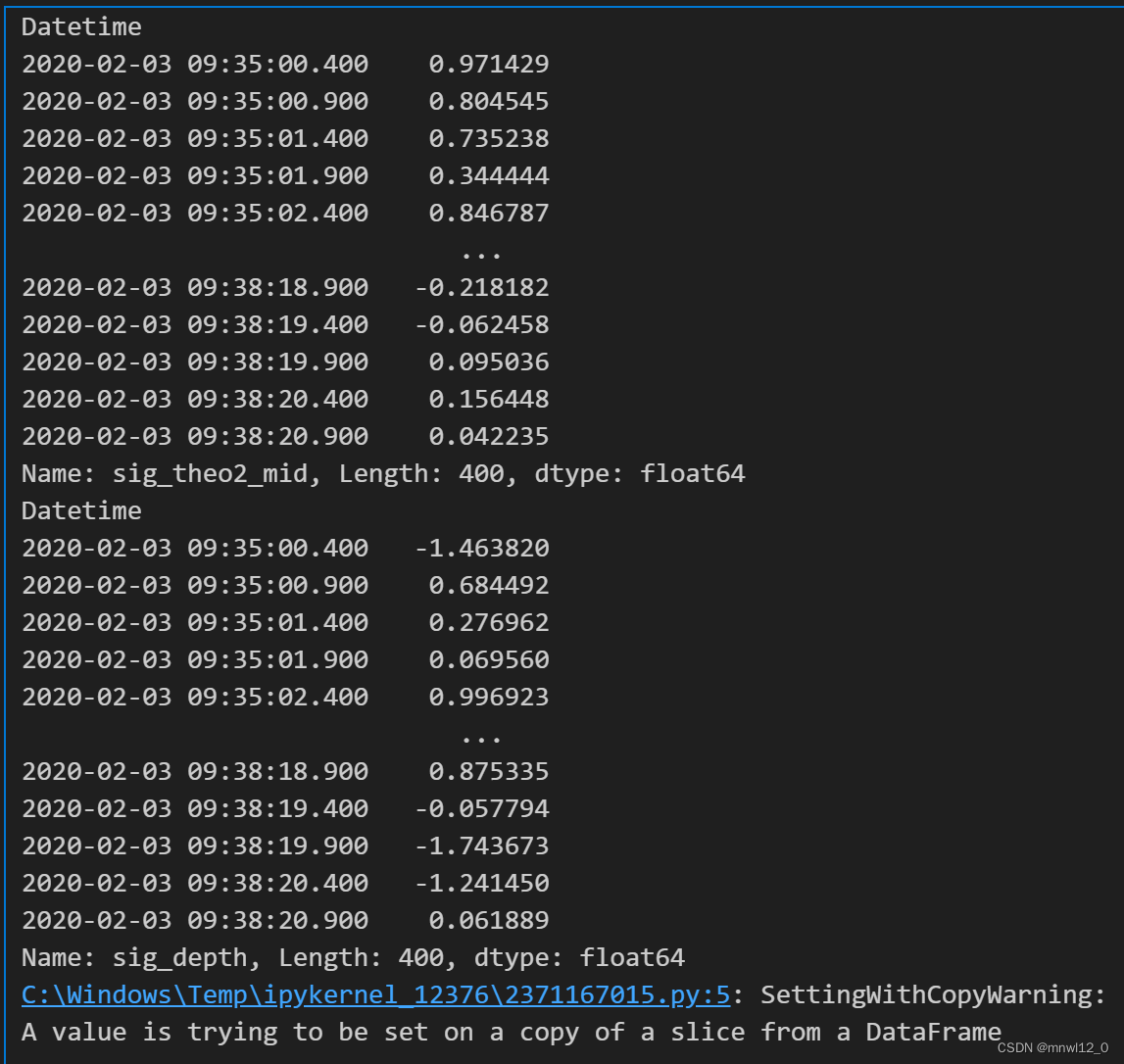

factor1 = sig_theo2_price(data, 0.5, '09:35:00','14:55:00')

factor2 = sig_depth(data, 0.5, 5, '09:35:00','14:55:00')

print(factor1)

print(factor2)

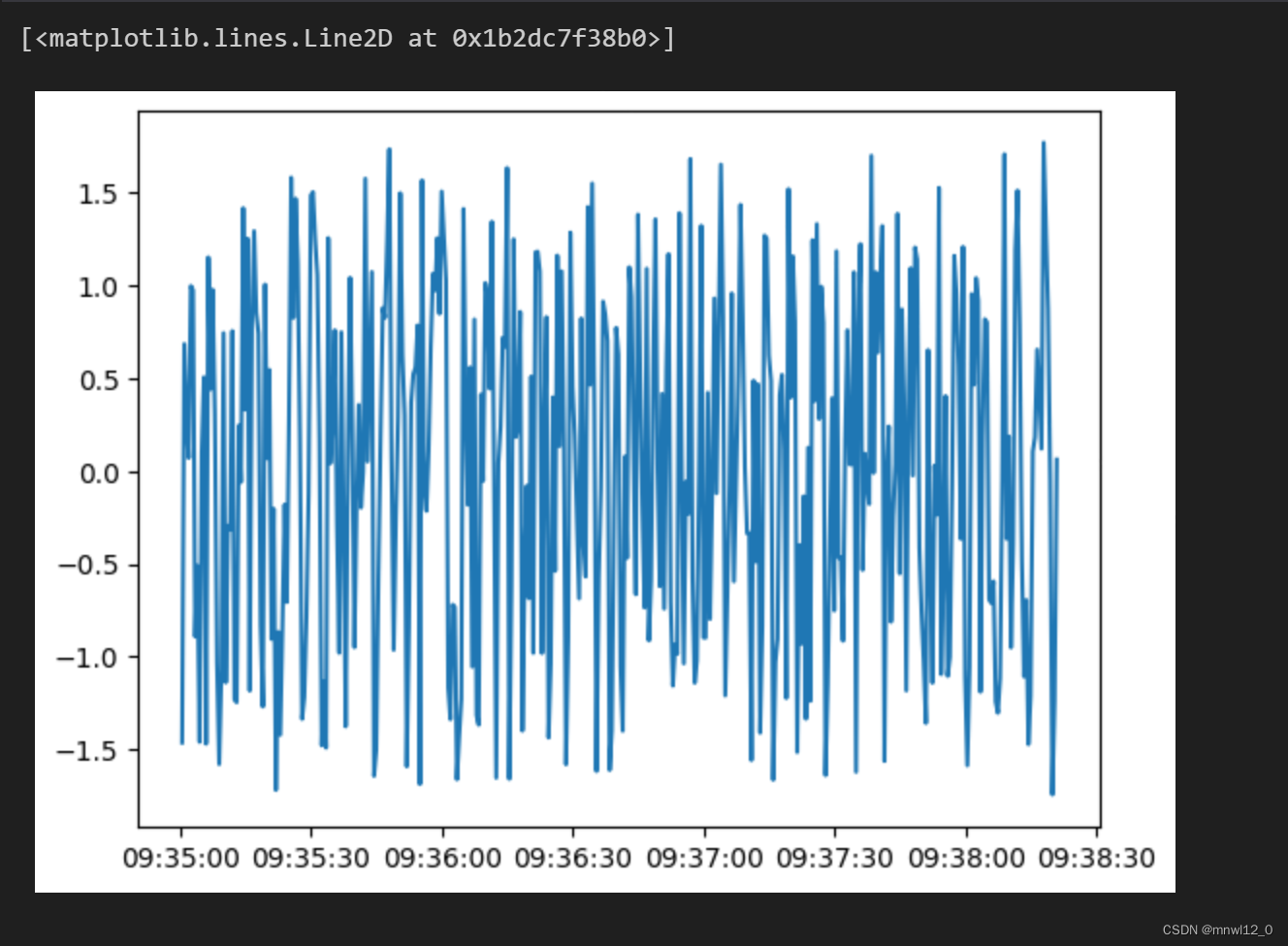

"""

对因子值画图,进行简单分析和数值调整

"""plt.plot(factor1)

plt.plot(factor2)

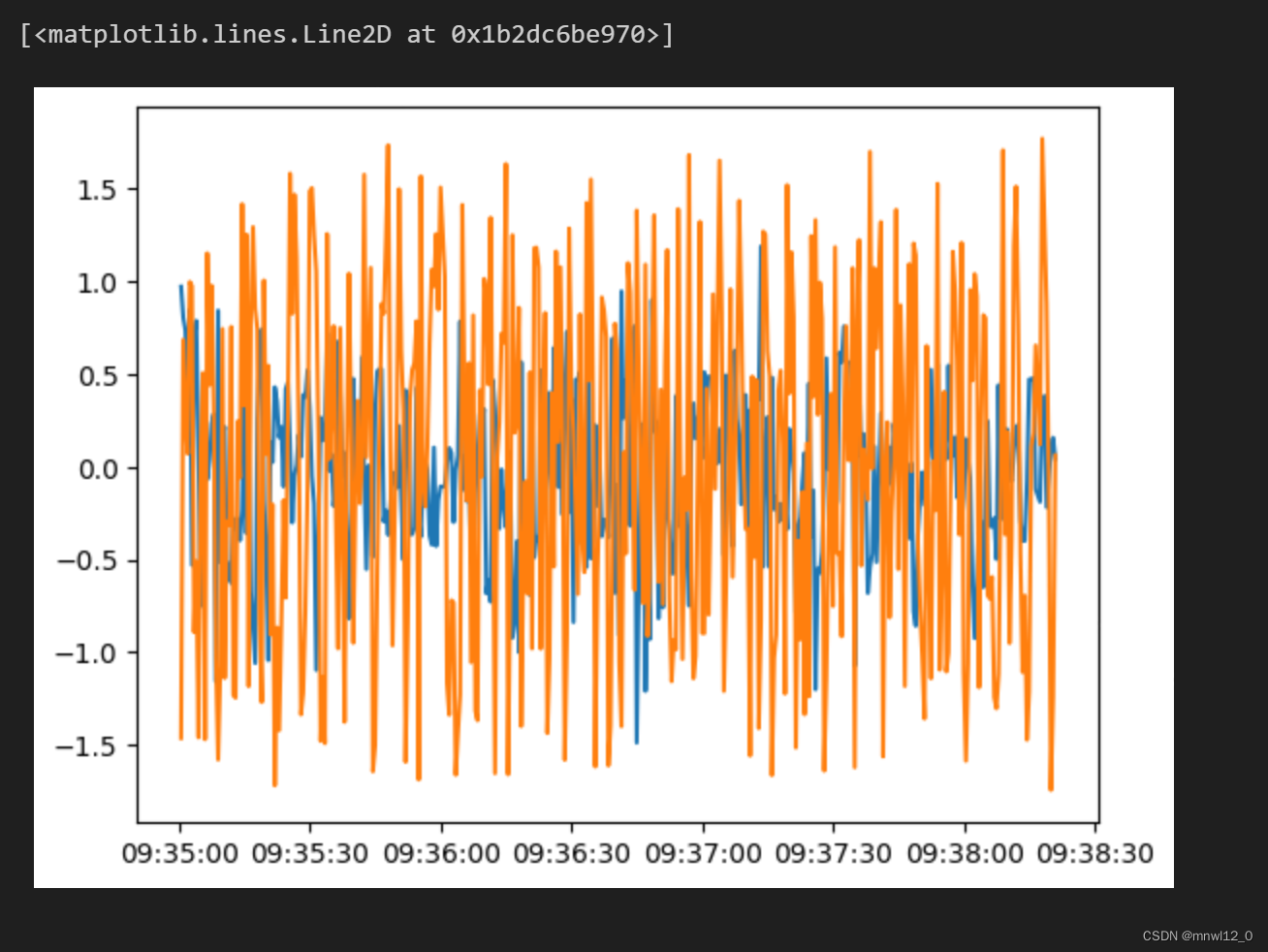

# 因子波动较大,存在大量噪声

# 可以参考置信区间的计算方法,设定临界值# 设置滚动窗口大小

window_size = 10# 计算滚动窗口的均值和标准差

rolling_mean = factor1.rolling(window=window_size, min_periods=1).mean()

rolling_std = factor1.rolling(window=window_size, min_periods=1).std()# 计算置信区间上下界(假设置信水平为95%)

confidence_interval = 1.96 * rolling_std # 1.96是95%置信水平对应的Z-score# 根据置信区间限制波动范围

upper_limit = rolling_mean + confidence_interval

lower_limit = rolling_mean - confidence_interval# 超出置信区间的波动直接取为临界值

price_diff_clipped = factor1.clip(upper=upper_limit, lower=lower_limit)# 绘制原始数据和置信区间

plt.figure(figsize=(10, 5))

plt.plot(factor1)

plt.plot(upper_limit, 'r--')

plt.plot(lower_limit, 'r--')

plt.legend()

plt.grid(True)

plt.show()

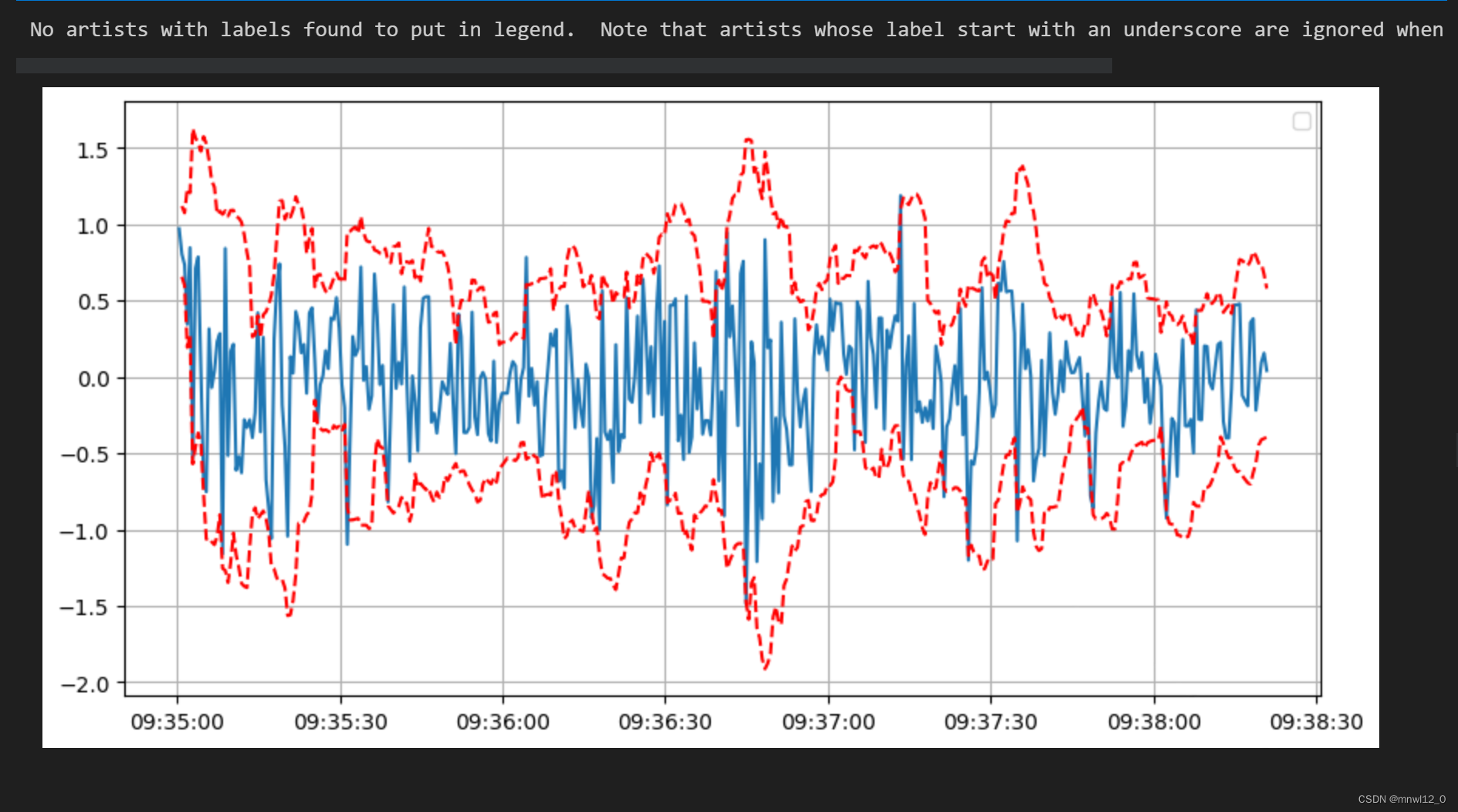

# 设置滚动窗口大小

window_size = 10# 计算滚动窗口的均值和标准差

rolling_mean = factor2.rolling(window=window_size, min_periods=1).mean()

rolling_std = factor2.rolling(window=window_size, min_periods=1).std()# 计算置信区间上下界(假设置信水平为95%)

confidence_interval = 1.96 * rolling_std # 1.96是95%置信水平对应的Z-score# 根据置信区间限制波动范围

upper_limit = rolling_mean + confidence_interval

lower_limit = rolling_mean - confidence_interval# 超出置信区间的波动直接取为临界值

volume_depth_clipped = factor2.clip(upper=upper_limit, lower=lower_limit)plt.plot(factor2)

"""将因子值与预测值组合成一个dataframe"""

two_factors = pd.concat([factor1,factor2], axis=1)target_time = pd.Timestamp('2020-02-03 09:35:00.400')

# 使用loc属性选择满足条件的数据

selected_data = RET_Index.loc[RET_Index.index >= target_time]

# 打印大于2020-02-03 09:35:00.400的数据

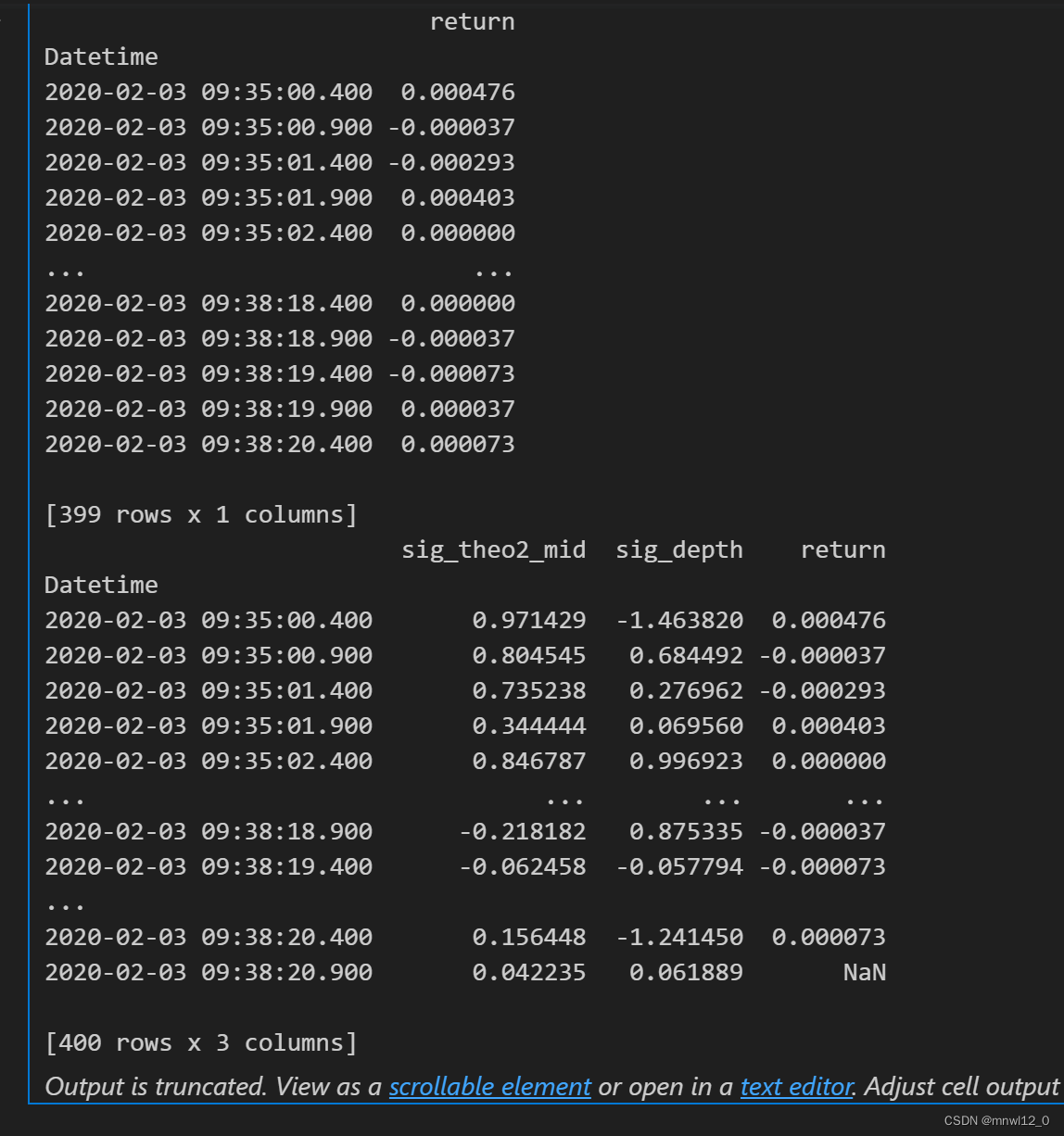

print(selected_data)combined_data = pd.concat([two_factors, selected_data], axis=1)

# 打印合并后的DataFrame

print(combined_data)

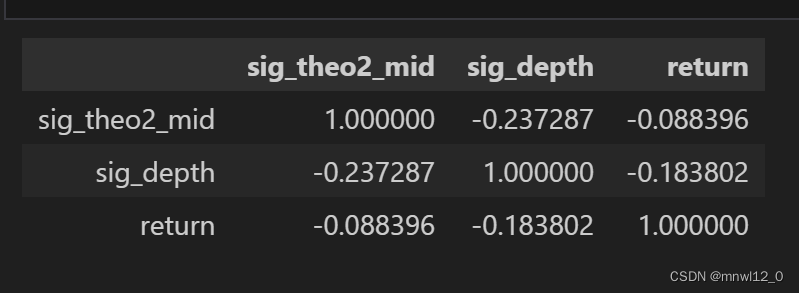

"""

单因子相关性分析

"""

corr_matrix = combined_data.corr()

corr_matrix

"""

因子数值稳定性(换手率和交易成本问题)结论,以及该怎么改进?

"""

# 计算因子sig_theo2_mid的均值和方差

mean_sig_theo2_mid = combined_data['sig_theo2_mid'].mean()

variance_sig_theo2_mid = combined_data['sig_theo2_mid'].var()# 计算因子sig_depth的均值和方差

mean_sig_depth = combined_data['sig_depth'].mean()

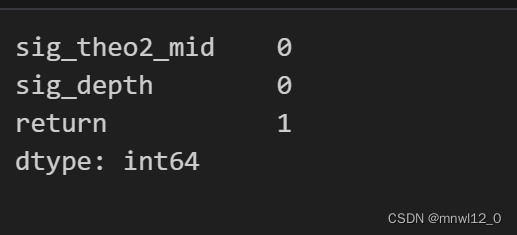

variance_sig_depth = combined_data['sig_depth'].var()variance_sig_depth# 因子sig_theo2_mid的数值稳定性相对sig_depth较好

combined_data.isnull().sum()

combined_data = combined_data.dropna()"""执行OLS拟合"""

combined_data.dtypesX = combined_data[['sig_theo2_mid', 'sig_depth']]

y = combined_data['return']# X = sm.add_constant(X)# 使用OLS类拟合线性模型

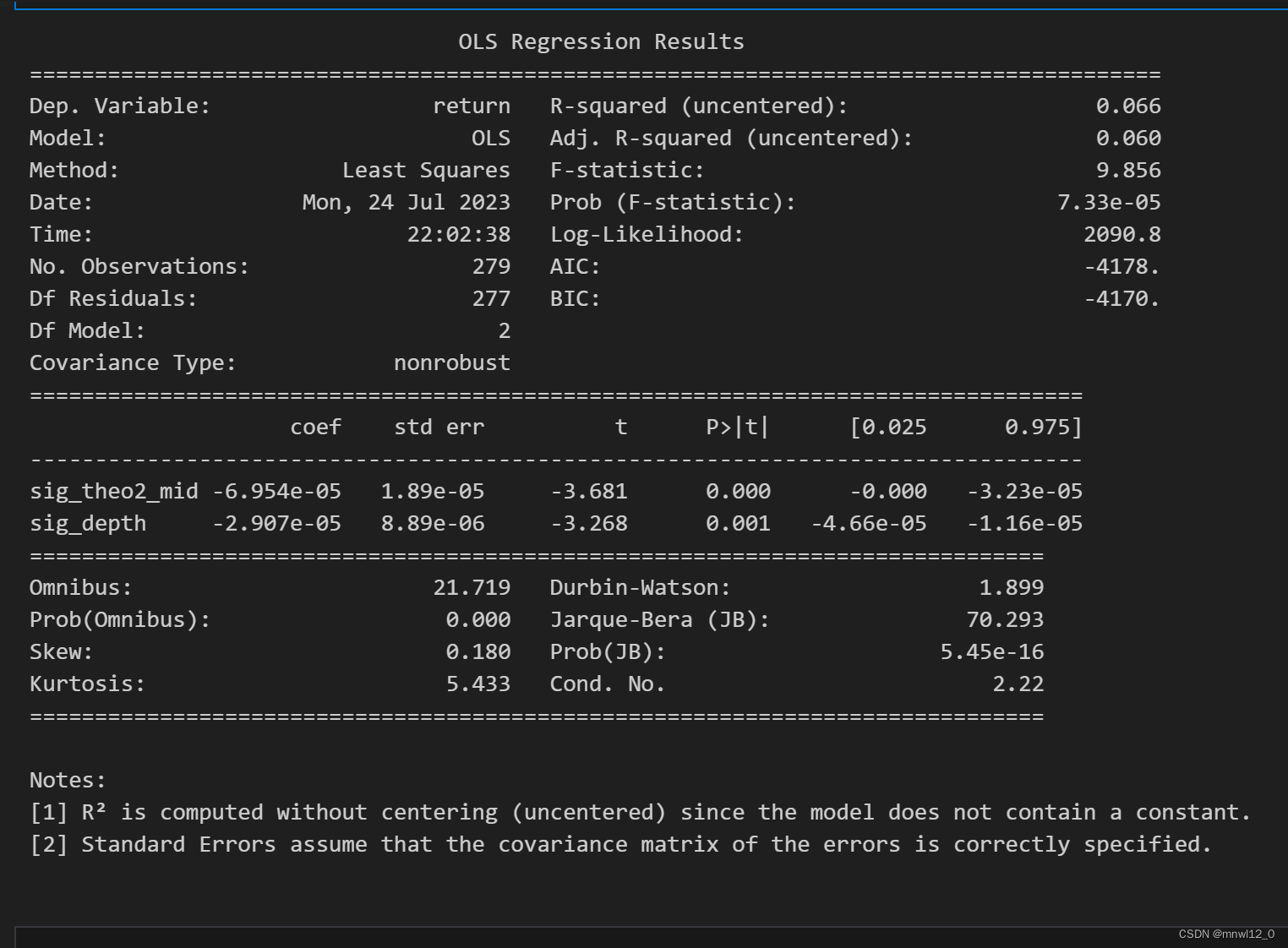

model = sm.OLS(y, X).fit()

# 打印模型摘要

print(model.summary())

"""

模型评估:线性模型的评估都包括哪些方面

"""

# MSE、MAE

from sklearn.metrics import mean_squared_error, mean_absolute_errormse = mean_squared_error(combined_data['return'], model.predict(X))

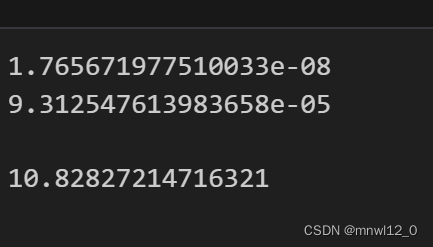

mae = mean_absolute_error(combined_data['return'], model.predict(X))print(mse)

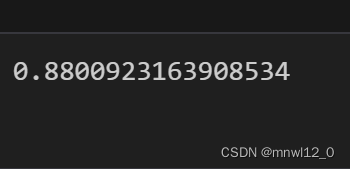

print(mae)f_statistic = model.fvalue

f_statistic

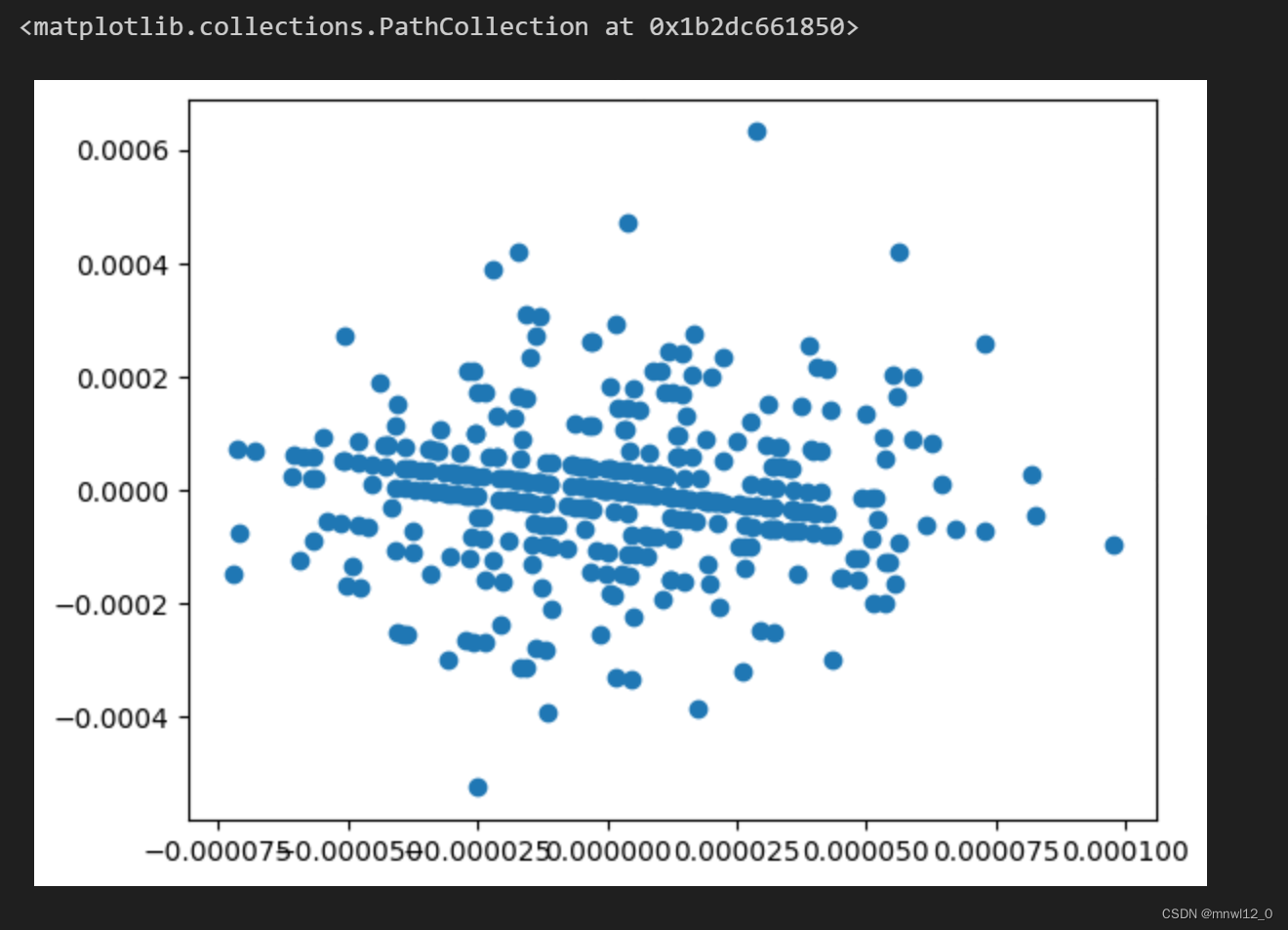

# 残差分析

residuals = combined_data['return'] - model.predict(X)plt.scatter(model.predict(X), residuals)

"""

思考两个问题:

1. 我们上述的线性模型中,有考虑截距吗?为什么?

2. 我们上述的模型评估使用了什么数据?这个结果完善了吗?

"""

#将样本切割为训练集和测试集,该模型在测试集上表现如何?

import pandas as pd

import statsmodels.api as sm

from sklearn.model_selection import train_test_split# 将自变量和因变量拆分出来

X = combined_data[['sig_theo2_mid', 'sig_depth']]

y = combined_data['return']# 将数据集划分为训练集和测试集

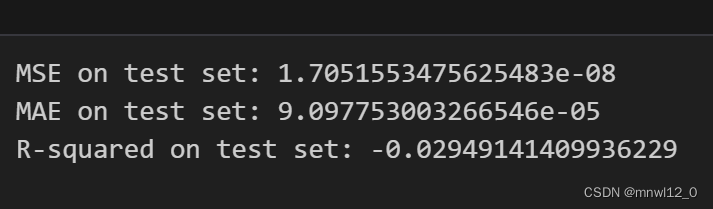

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42)# 使用OLS类拟合线性模型

model = sm.OLS(y_train, X_train).fit()# 打印模型摘要

print(model.summary())

# 评估模型在测试集上的表现

# 可以计算MSE、MAE、R-squared等评估指标,以及绘制残差图等

# 例如:

from sklearn.metrics import mean_squared_error, mean_absolute_error, r2_score# 在测试集上进行预测

y_pred_test = model.predict(X_test)mse_test = mean_squared_error(y_test, y_pred_test)

mae_test = mean_absolute_error(y_test, y_pred_test)

r_squared_test = r2_score(y_test, y_pred_test)

print("MSE on test set:", mse_test)

print("MAE on test set:", mae_test)

print("R-squared on test set:", r_squared_test)

这篇关于#7.21研究目标:预测510050股指期货未来收益率的文章就介绍到这儿,希望我们推荐的文章对编程师们有所帮助!