本文主要是介绍禄得可转债自定义因子交易系统,年化40%,最大回撤15%,希望对大家解决编程问题提供一定的参考价值,需要的开发者们随着小编来一起学习吧!

经过2个月的研究,和大佬们讨论轮动算法,选股算法,终于完成了可转债自定义因子轮动系统,非常感谢禄得老师的数据

文件链接 禄得可转债自定义因子交易系统,年化40%,最大回撤15% (qq.com)

网页 https://lude.cc/

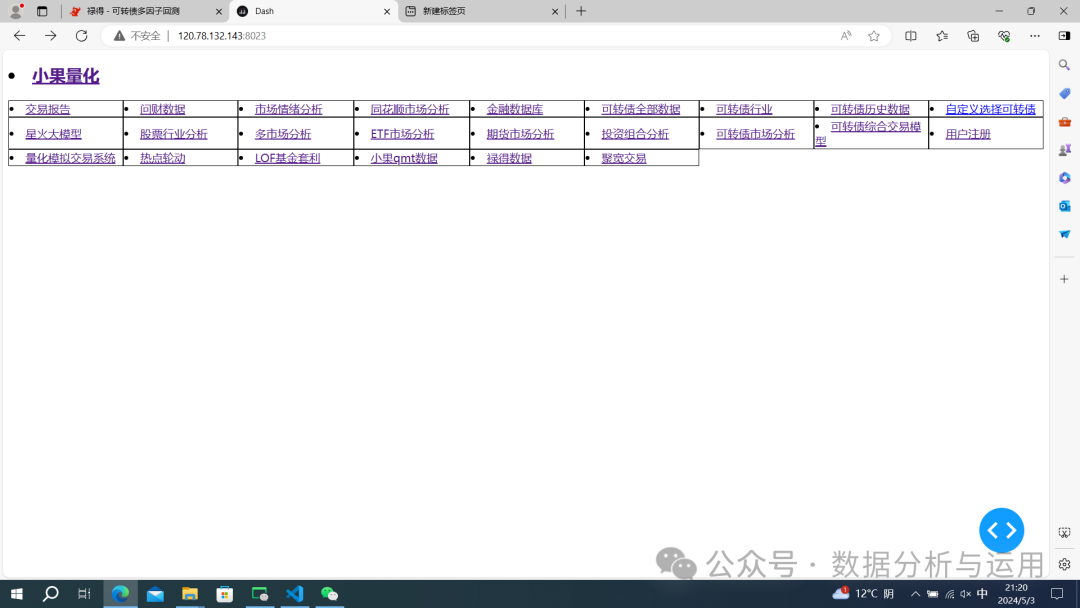

程序支持自定义数据,自定义股票池,我提供了服务器的数据支持

网页 http://120.78.132.143:8023/

可转债数据支持http://120.78.132.143:8023/lude_data_app

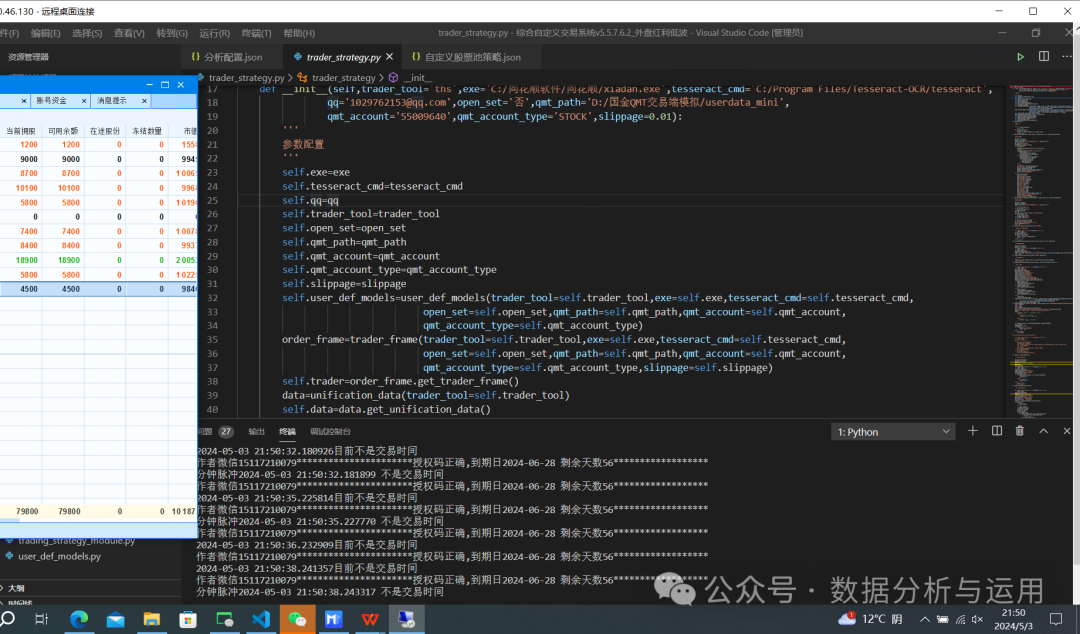

我实盘4个月了稳定的在服务器自动交易,还没有死机

24小时自动交易分析

服务器api支持

import pandas as pdimport requestsimport jsonclass lude_data_api:def __init__(self,url='http://120.78.132.143',port='8023',password='123456'):'''手动下载存数据库禄得数据apiurl服务器port端口password授权码'''self.url=urlself.port=portself.password=passworddef get_bond_data(self,date='2024-04-26'):'''获取可转债数据'''url='{}:{}/_dash-update-component'.format(self.url,self.port)headers={'Content-Type':'application/json'}data={"output":"lude_data_maker_table.data@669dd4696a628d8290353c138057eb97","outputs":{"id":"lude_data_maker_table","property":"data@669dd4696a628d8290353c138057eb97"},"inputs":[{"id":"password","property":"value","value":self.password},{"id":"lude_data_data_type","property":"value","value":"禄得数据"},{"id":"lude_data_end_date","property":"date","value":date},{"id":"lude_data_run","property":"value","value":"运行"},{"id":"lude_data_down_data","property":"value","value":"不下载数据"}],"changedPropIds":["lude_data_run.value"]}res=requests.post(url=url,data=json.dumps(data),headers=headers)text=res.json()df=pd.DataFrame(text['response']['lude_data_maker_table']['data'])return dfif __name__=='__main__':models=lude_data_api()df=models.get_bond_data(date='2019-01-15')print(df)

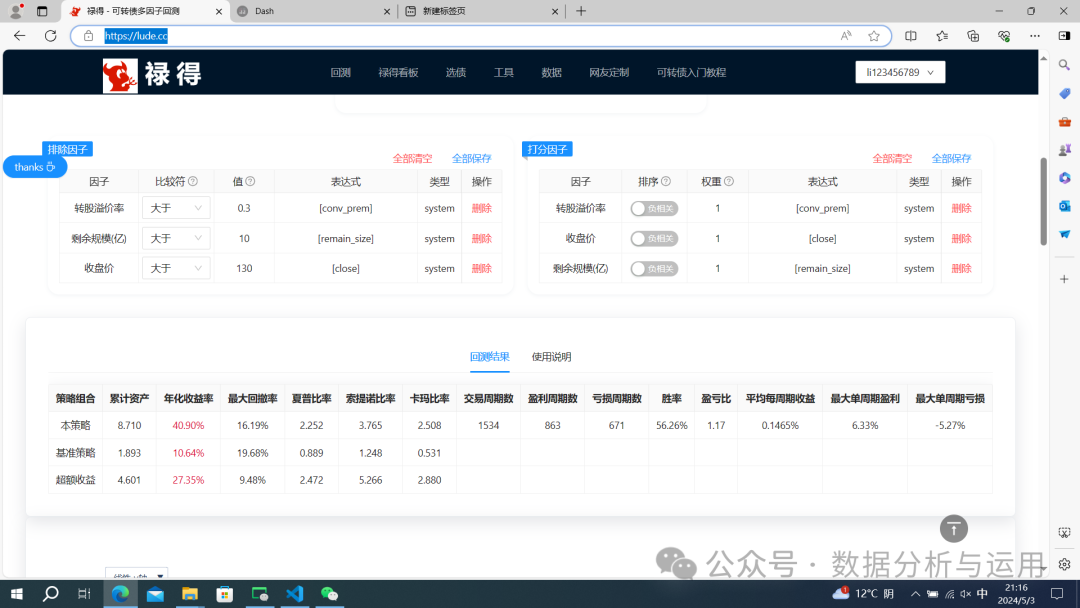

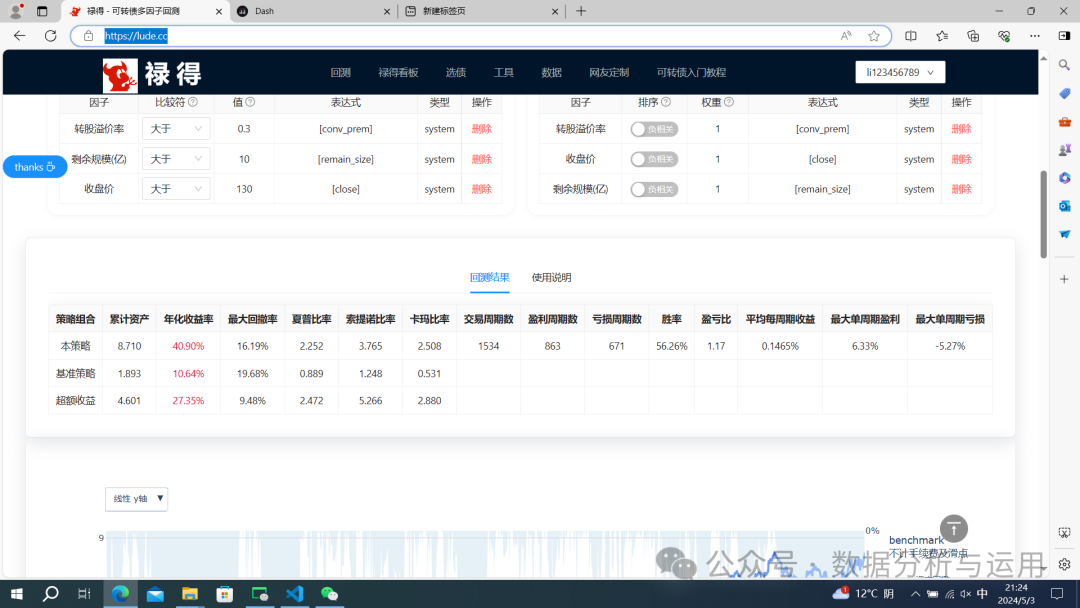

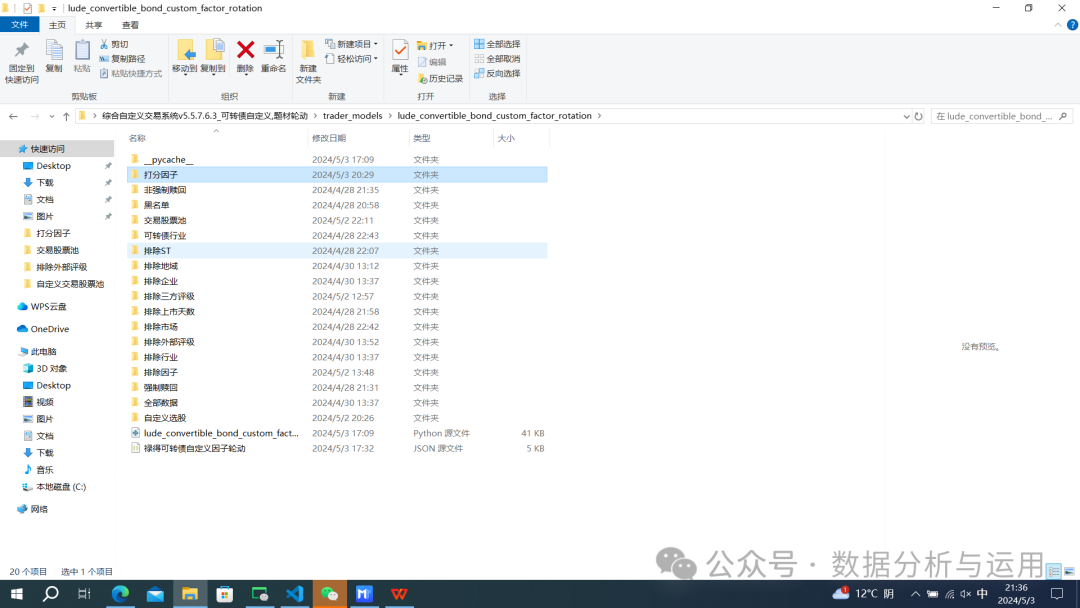

因子的设置和录得一模一样,兼容录得的设计

禄的设置因子

点击回撤,我也在开发回测程序,自动组合因子,年化40,最大回撤15

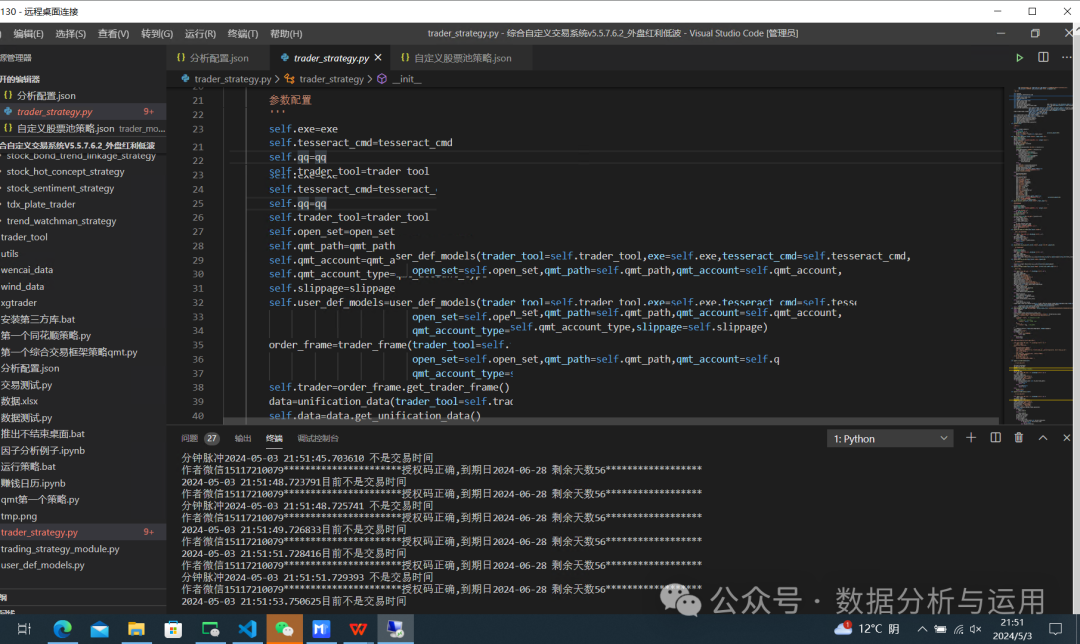

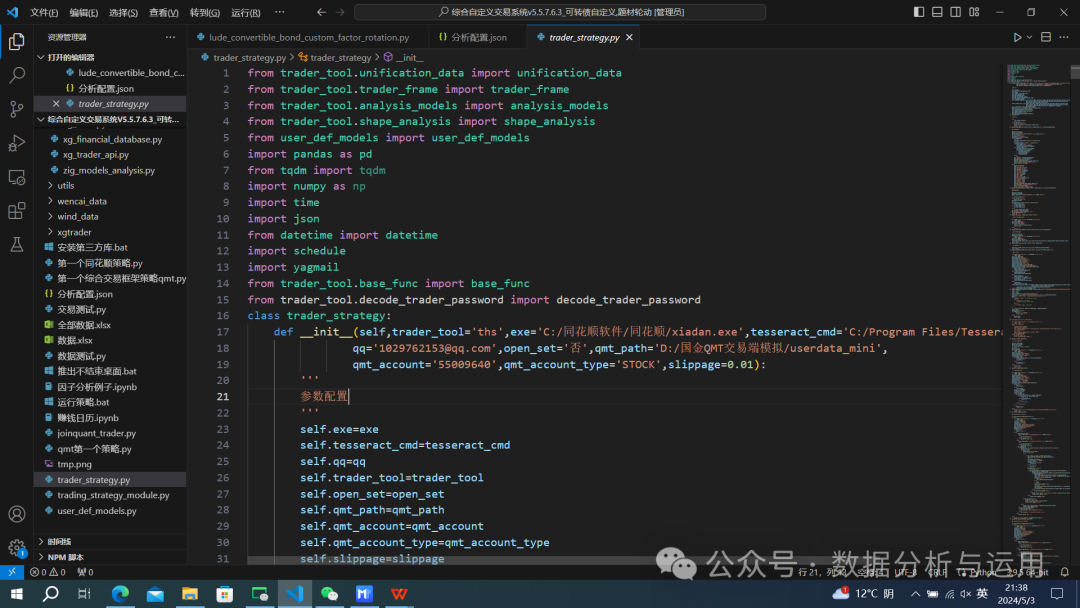

实盘设置打开qmt登录qmt,同花顺也可以

选择交易系统比如qmt

"交易系统设置":"*********************************************","交易系统选择":"ths/qmt","交易系统":"qmt","交易品种":"fund","交易品种说明":["stock","fund","bond","全部"],"同花顺下单路径":"C:/同花顺软件/同花顺/xiadan.exe","识别软件安装位置":"C:/Program Files/Tesseract-OCR/tesseract","qmt路径":"C:/国金QMT交易端模拟/userdata_mini","qmt账户":"55004082","qmt账户类型":"STOCK","证券公司交易设置":"兼容老牌证券公司可转债1手为单位","是否开启特殊证券公司交易设置":"否",

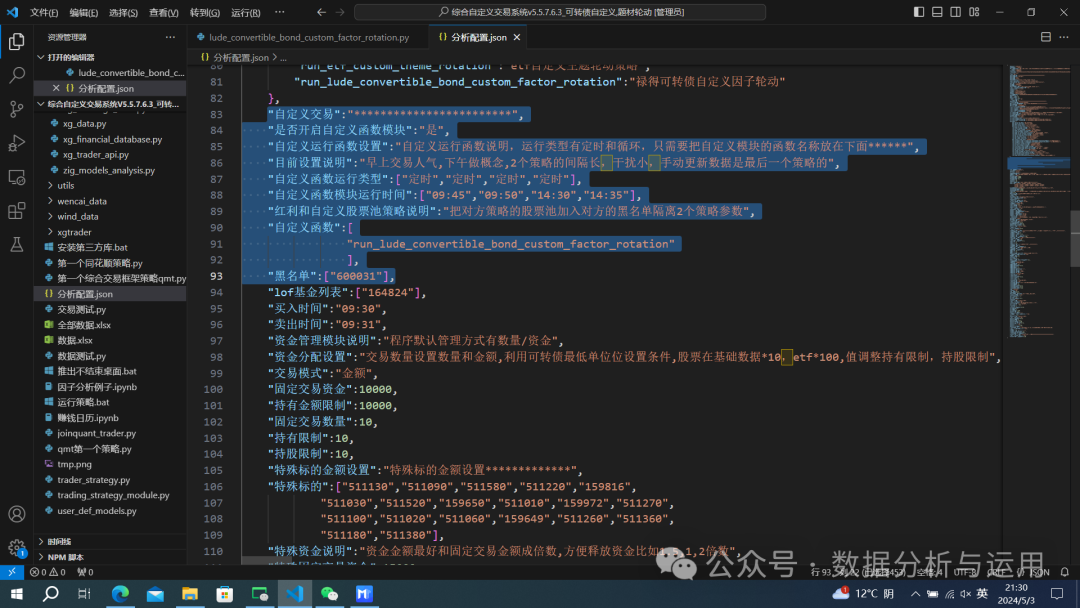

选择交易模型比如可转债自定义因子

"自定义交易":"************************","是否开启自定义函数模块":"是","自定义运行函数设置":"自定义运行函数说明,运行类型有定时和循环,只需要把自定义模块的函数名称放在下面******","目前设置说明":"早上交易人气,下午做概念,2个策略的间隔长,干扰小,手动更新数据是最后一个策略的","自定义函数运行类型":["定时","定时","定时","定时"],"自定义函数模块运行时间":["09:45","09:50","14:30","14:35"],"红利和自定义股票池策略说明":"把对方策略的股票池加入对方的黑名单隔离2个策略参数","自定义函数":["run_lude_convertible_bond_custom_factor_rotation"],"黑名单":["600031"],

全部的策略

设置资金模块

"交易模式":"金额","固定交易资金":10000,"持有金额限制":10000,"固定交易数量":10,"持有限制":10,"持股限制":10,"特殊标的金额设置":"特殊标的金额设置*************","特殊标的":["511130","511090","511580","511220","159816","511030","511520","159650","511010","159972","511270","511100","511020","511060","159649","511260","511360","511180","511380"],"特殊资金说明":"资金金额最好和固定交易金额成倍数,方便释放资金比如1.5,1,2倍数","特殊固定交易资金":15000,"特殊持有金额限制":15000,"滑点设置":"滑点设置滑点价格最后一位,比如滑点0.01,股票换掉0.01,etf,可转债滑点0.01/10=0.001价格最后一位,比如现在12.01,买入12.02,卖出12.00","滑点":0.01,

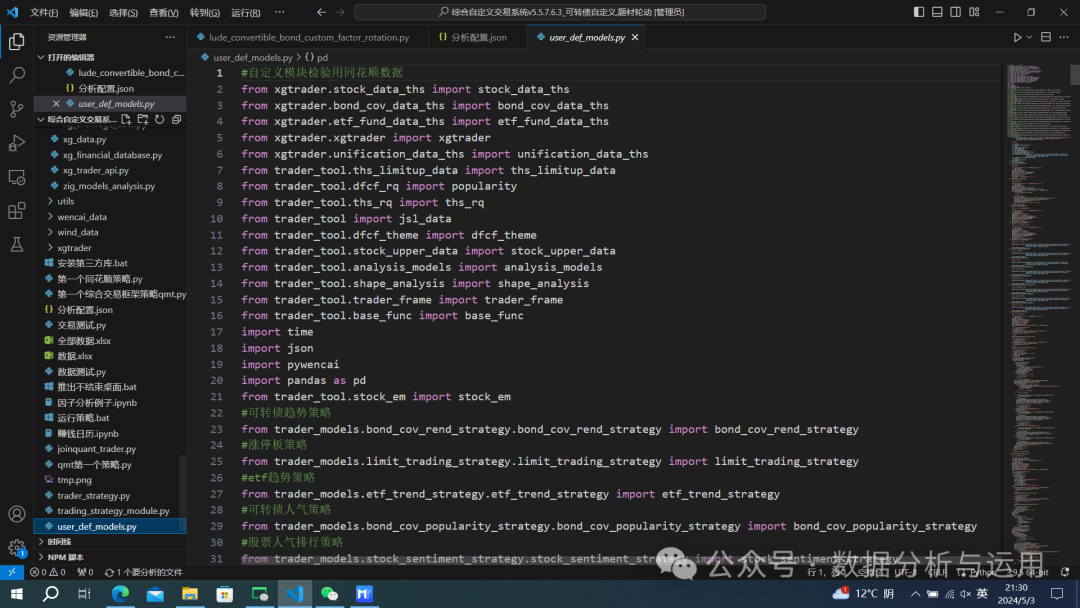

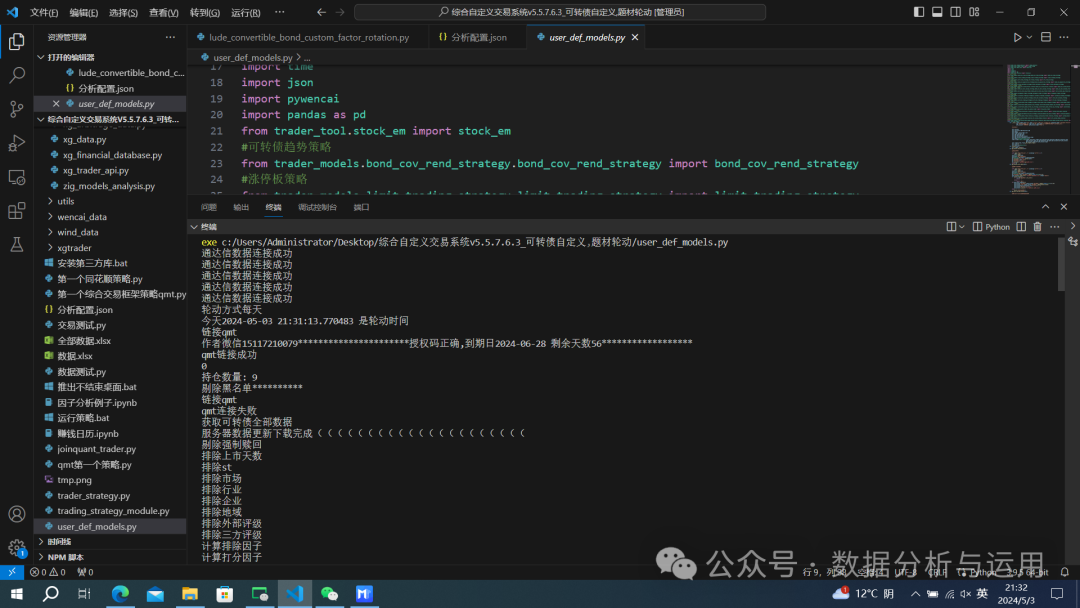

运行user def models更新数据

更新的结果

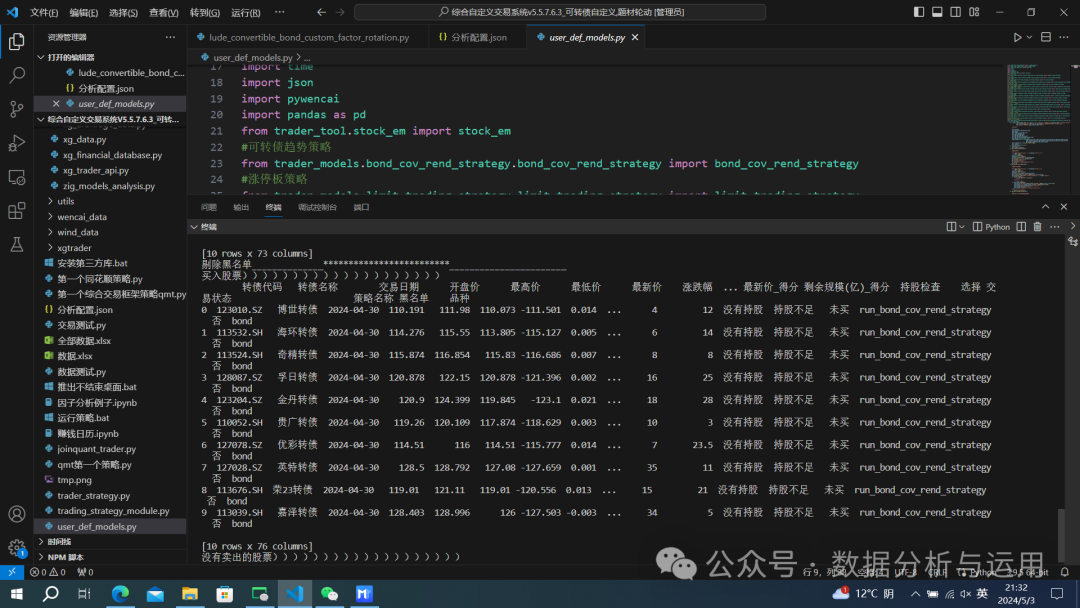

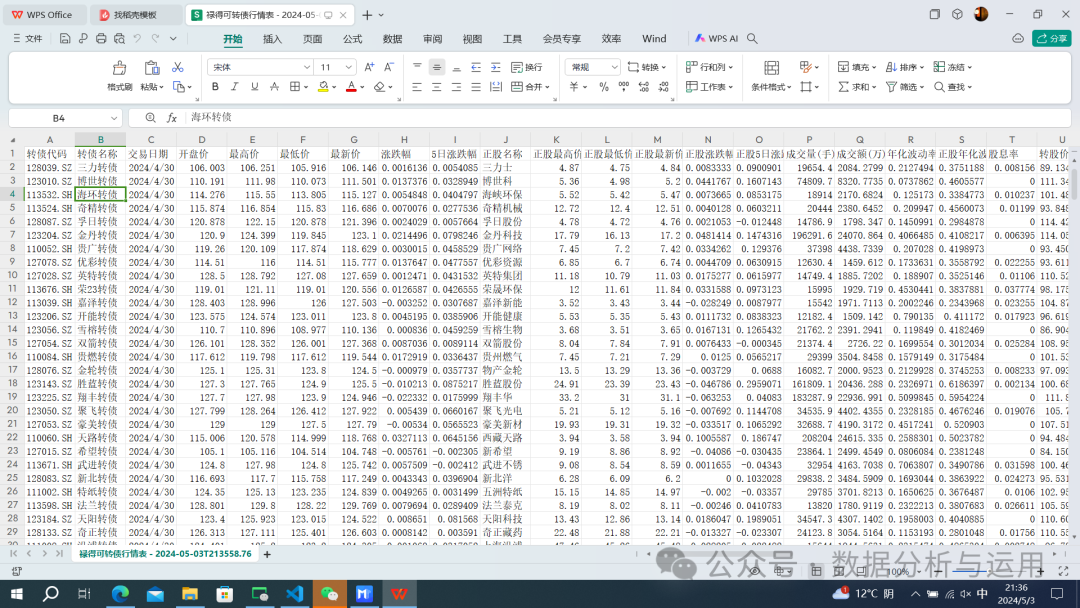

我们对比一下禄得的选股,禄得的选股结果

程序自动分析的选股结果

看打分因子一样的结果

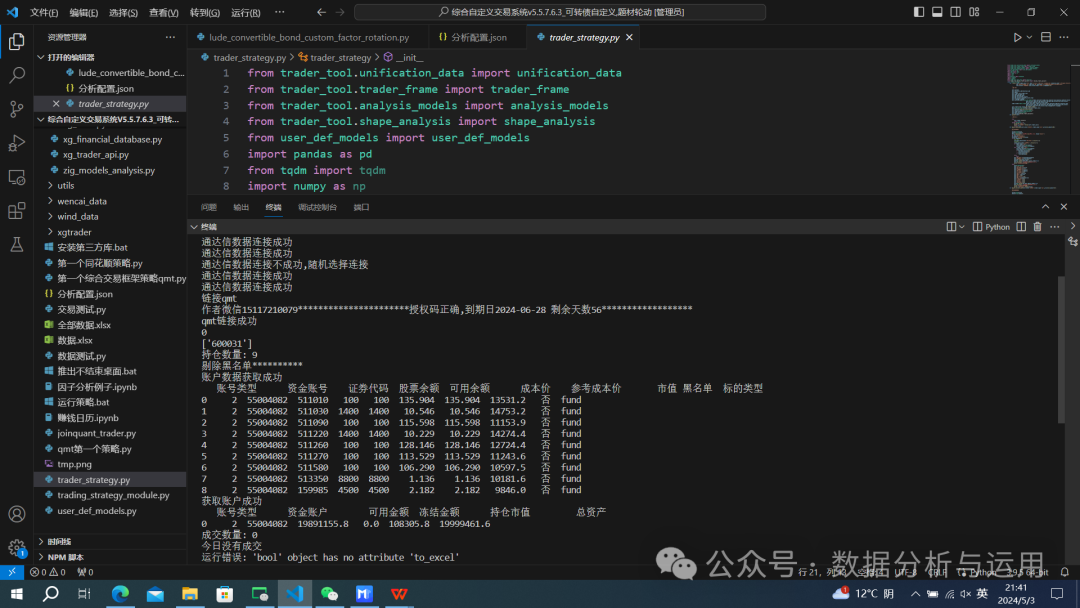

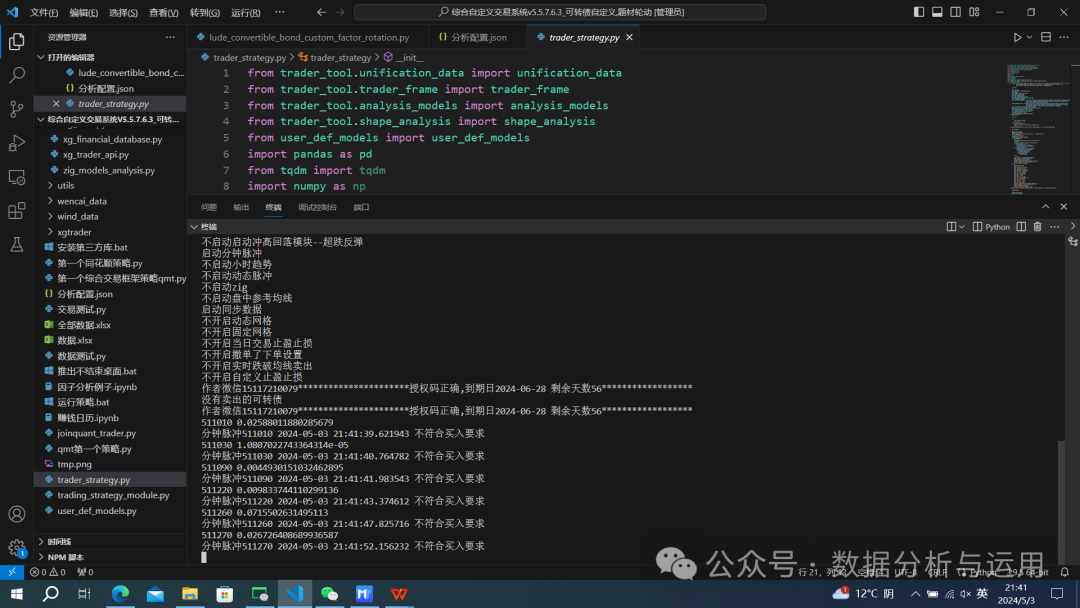

运行trader st进入24小时实盘交易

运行是结果

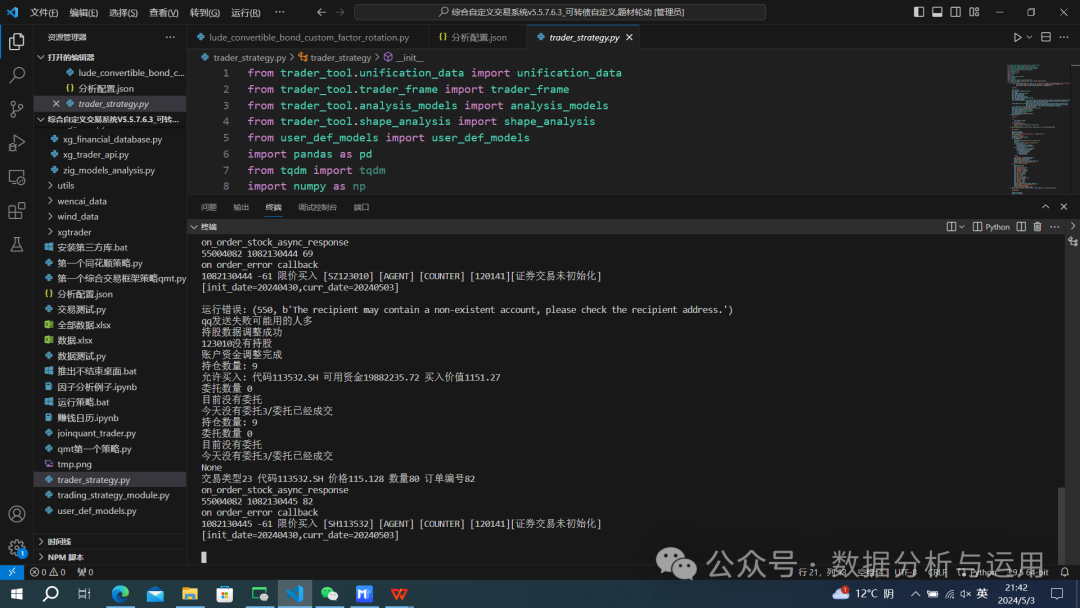

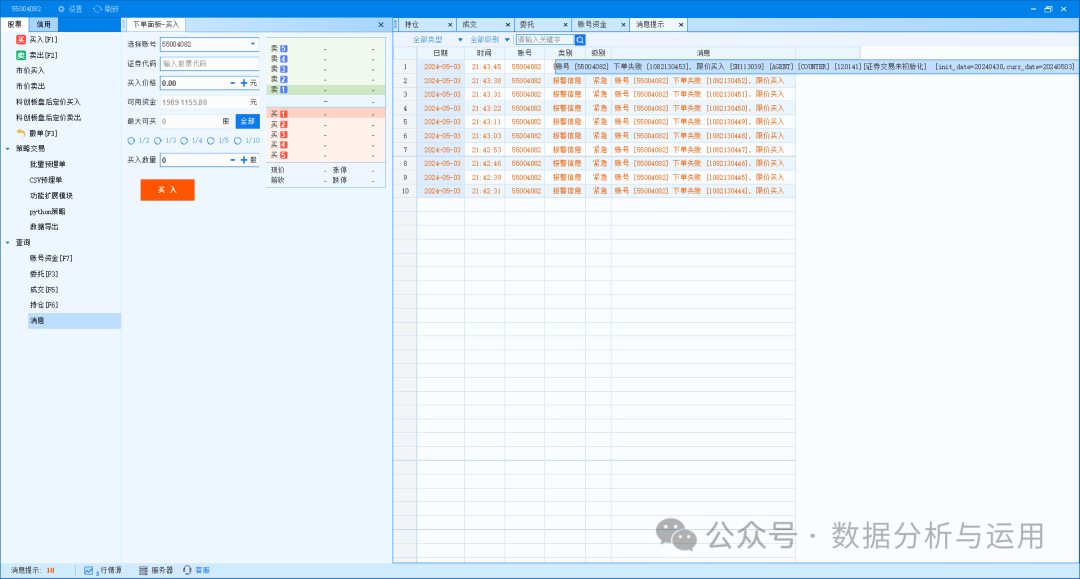

下单的结果

周末委托下单失败

全部的代码我上传了知识星球可以直接下载使用

加我备注加群可以进入我的量化交流群,很多大佬一起研究策略

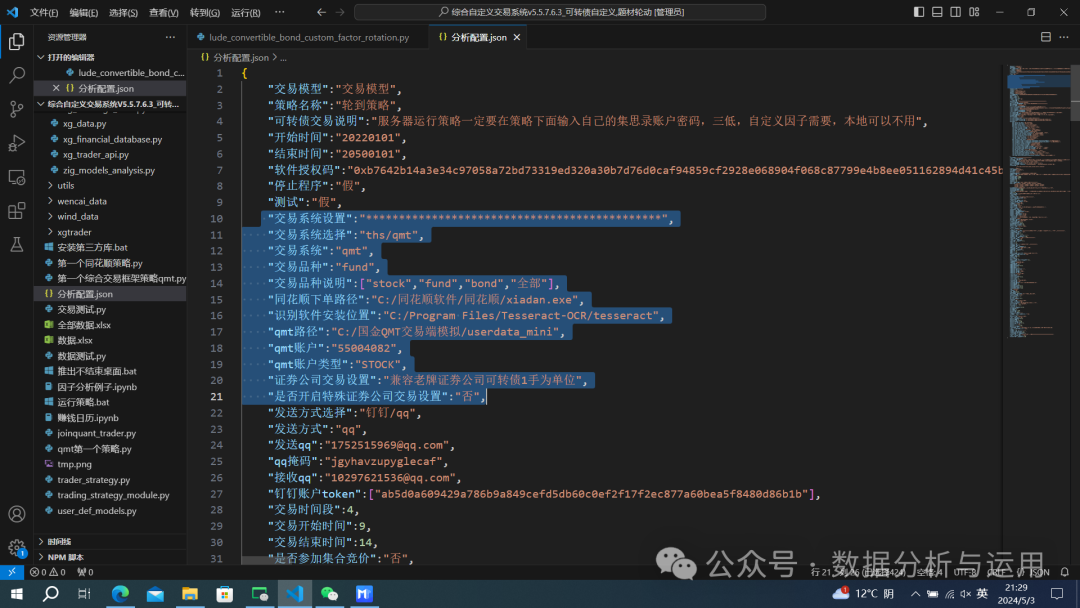

全部的参数,可转债自定义因子轮动

{"可转债溢价率设置":"可转债溢价率设置","数据源模式说明":"服务器/自定义","数据源":"服务器","服务器":"http://120.78.132.143","端口":"8023","授权码":"123456","是否测试":"否","是否数据没有更新的情况下更新":"是","强制赎回设置":"************************","是否剔除强制赎回":"是","距离强制赎回天数":0,"排除上市天数":3,"是否排除ST":"是","市场说明":["沪市主板","深市主板","创业板","科创板"],"排除市场":[],"行业说明":"查询行业表**********,混合排除不区分一二三级行业","排除行业":[],"企业类型说明":["民营企业","地方国有企业","中央国有企业","外资企业","中外合资经营企业","集体企业"],"排除企业类型":[],"排除地域说明":["陕西", "山西", "山东", "河南", "新疆", "安徽", "西藏", "海南", "湖北", "河北","福建", "广西", "内蒙古", "浙江", "江西", "江苏", "上海", "贵州", "黑龙江", "湖南", "甘肃","宁夏", "云南", "天津", "广东", "四川", "北京", "辽宁", "重庆"],"排除地域":[],"排除外部评级说明":["AAA", "AA+", "AA", "AA-", "A+", "A", "A-","BBB+", "BBB", "BBB-", "BB+", "BB", "BB-", "B+", "B", "B-", "CCC", "CC"],"排除外部评级":["B","B-","CCC","CC"],"排除三方评级说明":["1", "2", "3", "4+", "4", "4-", "5+", "5", "5-", "6+", "6","6-", "7+", "7", "7-", "8+", "8", "8-", "9", "10"],"排除三方评级":["10","9","8"],"添加排除因子":"排除因子设置************************","全部的排除因子打分因子,必须选择可以计算的":["开盘价", "最高价", "最低价", "最新价", "涨跌幅", "5日涨跌幅","正股最高价", "正股最低价", "正股最新价", "正股涨跌幅", "正股5日涨跌幅", "成交量(手)","成交额(万)", "年化波动率", "正股年化波动率", "股息率", "转股价值", "转股溢价率", "理论转股溢价率","修正转股溢价率", "纯债价值", "纯债溢价率", "期权价值", "理论价值", "理论偏离度", "双低","剩余规模(亿)", "剩余市值(亿)", "换手率", "市净率", "市盈率_ttm", "市销率_ttm", "正股流通市值(亿)","正股总市值(亿)", "资产负债率", "转债市占比", "上市天数", "转股截止日", "剩余年限","到期收益率(税前)", "强赎触发比例", "外部评级", "三方评级", "企业类型", "地域", "一级行业", "二级行业", "三级行业"],"因子计算符号说明":"大于,小于,大于排名%,小于排名%,空值,排除是相反的,大于是小于","排除因子":["剩余规模(亿)","最新价","转股溢价率"],"因子计算符号":["大于","大于","大于"],"因子值":[10,130,0.3],"打分因子设置":"*************************************************","打分因子说明":"正相关:因子值越大得分越高;负相关:因子值越大得分越低,","打分因子":["转股溢价率","最新价","剩余规模(亿)"],"因子相关性":["负相关","负相关","负相关"],"因子权重":[1,1,1],"持有限制":10,"持股限制":10,"策略轮动设置":"策略轮动设置************************,轮动都按排名来","轮动方式说明":"每天/每周/每月/特别时间","轮动方式":"每天","说明":"每天按自定义函数运行","每周轮动是说明":"每周比如0是星期一,4是星期五**********","每周轮动时间":0,"每月轮动是说明":"必须是交易日,需要自己每个月自动输入**********","每月轮动时间":["2024-02-29","2024-02-29","2024-02-29","2024-02-29","2024-02-29","2024-02-29","2024-02-29"],"特定时间说明":"特别的应该交易日","特定时间":["2024-02-23","2024-02-24","2024-02-25","2024-02-26","2024-02-27"],"轮动规则设置":"轮动规则设置88888888**********排名","买入排名前N":10,"持有排名前N":10,"跌出排名卖出N":10,"买入前N":5}

这篇关于禄得可转债自定义因子交易系统,年化40%,最大回撤15%的文章就介绍到这儿,希望我们推荐的文章对编程师们有所帮助!